Last Updated on November 22, 2025

When we die, life still goes on for our loved ones. And, that includes bills and expenses associated with our death, our medical expenses, and any of our outstanding obligations. It is for this reason that it is why it is so important to protect your family by securing a diabetic life insurance policy. After all, life insurance is the most tax efficient way, to protect your family and all the assets you have accumulated.

We have all heard the stories about this insurance company denying someone life insurance due to Type 1 diabetes or Type 2 Diabetes, another denying life insurance for a different reason. The stories are common, and they vary greatly from company to company. If you have been diagnosed with diabetes, you may feel that the same will happen to you – or that the premiums will be entirely out of your price range.

You will be happy to know that we’ve got some good news for you: now you can qualify for affordable life insurance for diabetics. Studies have shown that those with diabetes who apply for coverage, are approved with lower rates than they originally imagined. We have even written an article that provides tips on saving money on life insurance with diabetes in the past.

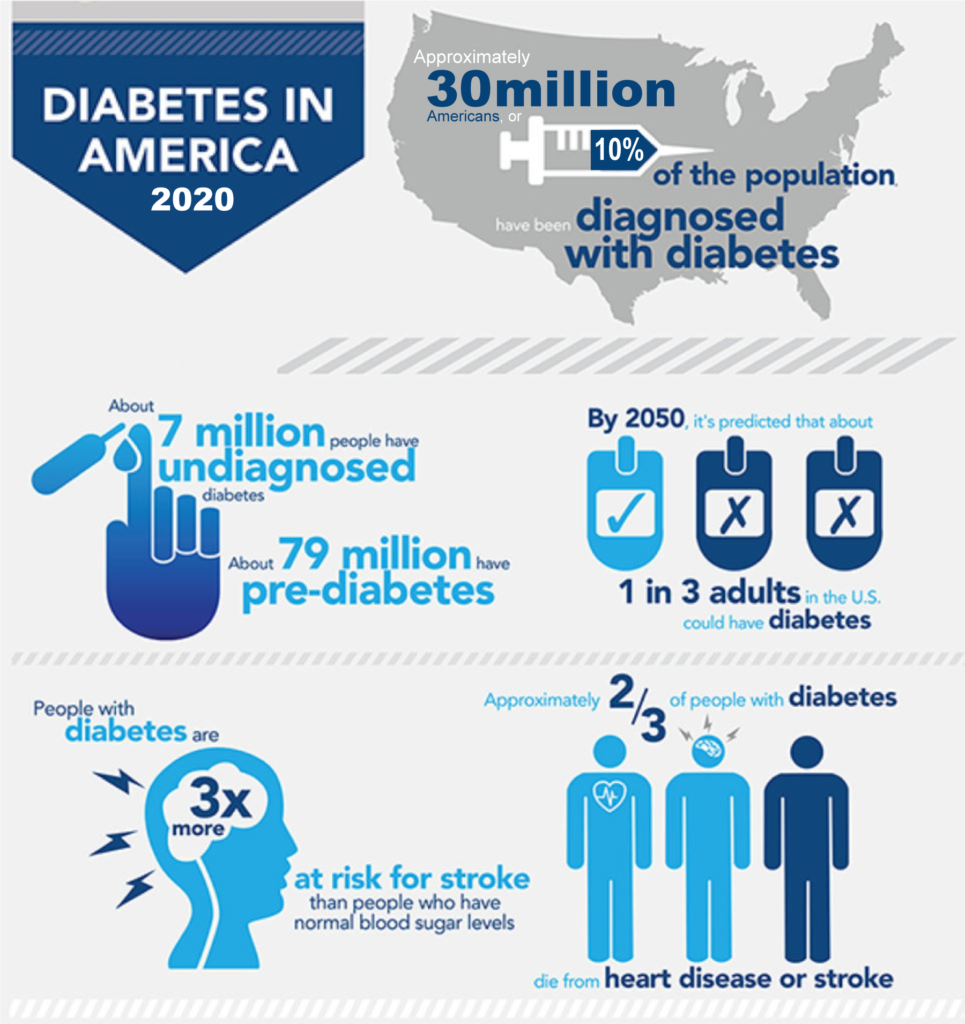

Over the years, diabetes has become more prevalent among the U.S. population. In fact, according to the American Diabetes Association, over 30 million Americans have diabetes, as of 2020. That is nearly 10% of our population! That number does not include the 84 million adults who have prediabetes or gestational diabetes.

Therefore, because of the overwhelming number of individuals with diabetes, life insurance companies have had to start specializing in affordable life insurance for diabetics. Rates for life insurance with diabetes are actually at an all time low! And the Diabetes Community have never had as many options to choose from, when applying for life insurance.

People with Diabetes have access to all the same type of policies as the rest of the general public does. Including term life insurance, whole life insurance, guaranteed acceptance life insurance, guaranteed universal life insurance and indexed universal life insurance.

Ready for some more good news? Diabetes Life Solutions Company – An affordable life insurance company will help you to find the best rate for your best policy. Leave the hard work and the research to us!

The Effects of Diabetes on Life Insurance

Diabetes can wreak havoc on your body over time – and life insurance companies know this. In fact, these long-term effects cause insurance companies to take extra precautions when reviewing applications from those with diabetes, and the premiums for a diabetic may be higher compared to a person without diabetes. When making a determination to offer affordable life insurance with diabetes, many of these companies take a few things specifically relating to your diabetes diagnosis into consideration. A few of the most common details they like to review are:

- When were you diagnosed with diabetes? Because of the damage that long-term diabetes can cause, those who are newly diagnosed or have acquired it as an adult usually find more options. Some companies are more favorable to to juvenile diabetes onset, while other automatically charge higher rates

- Your average blood sugar level and glucose readings are important – and it can show how well managed your condition is. This is incredibly important as most insurance companies will take the a1c reading, which gives an average of your blood sugar levels for the last two to three months.

- Any Diabetes related complications?

- What type of medication you take, if any, and the dosage. Certain life insurance companies will rate you higher depending on the units of insulin taking daily, while others aren’t concerned about the number of units taken daily. Rather they are just concerned about the overall control of the diabetes.

If your diabetes is managed and under control, you may find that you can receive a plethora of good offers with reasonable life insurance rates for diabetics. You may even receive offers better than a person who does not have Diabetes. However, if you are not taking your diabetes diagnosis seriously, then you may find that you are listed as a high risk and will have fewer options to choose from to meet your life insurance needs.

During the application process, many life insurance companies will ask you certain medical questions in relation to your diabetes diagnosis. It is important that you be prepared to answer these questions and do so honestly. The answers to these questions will be taken into consideration when determining your eligibility for affordable life insurance with diabetes policy. (Please note that less than favorable answers do not mean an automatic denial of coverage.)

- Date of onset or diagnosis.

- Most current hemoglobin A1C test reading. Include the date and the average reading.

- How often do you visit your physician for a diabetes checkup?

- How do you control your diabetes? Insulin? Oral medication? Diet and exercise?

- If you have Type 1 diabetes, are you using Diabetes related technology? Insulin pumps? Continuous Glucose Monitoring devices?

- Recent height, weight, and blood pressure.

- What other prescription medications do you take?

- Have you experienced any of the following: weight problems, coronary artery disease, neuropathy, protein in the urine, high blood pressure, abnormal ECG, retinopathy, albuminuria, chest pain, elevated lipids, kidney disease, insulin shock, diabetic coma?

- Do you have any other significant health issues? History of heart attacks, strokes, cancer?

- Do you have a history of drug or alcohol abuse?

Insurance companies will use this information – as well as other information obtained – to determine your level of risk and can then, in turn, provide you with a final offer

Other Medical Issues are also Considered

Diabetes may cause a slight hassle when it comes to obtaining a life diabetic insurance policy. However, it is far more common to run into obstacles when you are also dealing with other health-related issues. For example, if you are overweight, if you are a smoker, if you suffer from heart disease or have heart problems, if you have been diagnosed with the pulmonary disease, or if your family has a history of various types of cancer. All of these things compounded can increase your risk in the eyes of the insurance company. And, unfortunately, this results in a lower number of offers and increased rates. If you have Diabetes along with a history of these types of health issues, your premiums for life insurance will be highly “table rated”.

Want to Skip the Medical Exam?

For some individuals with Diabetes, submitting oneself to the life insurance company’s medical exam can feel invasive and like a lot of extra work. Lots of people with Diabetes are already seeing their Endocrinologist every 3 months, and having their blood work done and tested. Unfortunately, most life insurance companies will STILL require a Blood/Urine test, from an independent examination company.

Generally, it takes place in two parts. First, is the medical history questionnaire, the second is a basic physical examination. An examiner will meet with you, and collect a Blood and Urine sample. They will also check your height and weight. Next, they’ll ask a detailed questionnaire of several health questions, and family health history. Depending on your age, and amount of coverage seeking, they may also conduct an EKG.

Also, companies will require a review of your most recent medical records. This includes obtaining records from your primary physician, and endocrinologist. If you’ve seen other specialists, the diabetic insurance companies may require records from those Doctors as well. All of this information is then reviewed by an Underwriter, and your final rates are based off your complete health profile.

However, believe it or not, this dreaded life insurance medical exam, and medical records review can be skipped altogether.

If you are an individual who doesn’t have time for an exam, or who doesn’t want an insurance company looking at all your detailed history, then a non medical exam life insurance policy is probably the best option for you.

Each non medical exam life insurance company will have their own underwriting guidelines, for Diabetic applicants. Obtaining non medical exam life insurance with type 1 diabetes is obtainable. However, you won’t have as many options, compared to a person with type 2 diabetes. Getting life insurance with pre-diabetes or gestational diabetes without an exam isn’t an issue either. Certain non medical exam companies can offer an approval in a matter of minutes, or days. If not wanting to wait weeks for a decision, then you are in luck! Most companies make their final decision for approval in a matter of minutes, or days.

These non medical exam life insurance for diabetics policies are usually more expensive than a traditional fully underwritten policy. And, because they are not able to determine your overall health or risk level, you may be capped on the amount of life insurance you can purchase. Most companies may limit you to $500,000 per policy. However, you can always take out multiple life insurance policies, to obtain a specific amount of life insurance for your family.

It is up to you to weigh your options and decide how much diabetic life insurance coverage you need and whether you want to possibly pay a higher price to avoid the medical exam. Consider your answers to the following:

It is up to you to weigh your options and decide how much diabetic life insurance coverage you need and whether you want to possibly pay a higher price to avoid the medical exam. Consider your answers to the following:

- How confident are you that your level of Diabetes control is favorable to life insurance companies?

- Do you want to wait 3-4 weeks for an insurance company to order, and review medical records? If the life insurance you’re seeking is for a SBA loan, or court ordered for a divorce, can you wait that long?

- Will your medical records or lab results pose a problem for you in obtaining affordable, traditional life insurance? If your lab results are out of normal range, life insurance carriers will add “table ratings” to your policy, leading to higher rates?

- Have you previously applied and been denied life insurance? If so, why were you declined? You’ll need to provide details as the decline from your previous application will show up in the Medical Information Bureau review.

In order for life insurance companies to offer the best life insurance rates for Diabetics, they will likely require you to complete the medical exam. A few companies will give you the option of waiving the exam, if you consent to having your medical records reviewed instead.

If you don’t feel like applying for a policy that requires an exam initially, you can always start with a non medical exam policy. And in the future, re-apply for another policy, in the hopes of getting a better offer. Otherwise, you will find yourself having to dig deeper into your pockets.

The Best Way to Obtain Affordable Life Insurance with Diabetes

It is likely that you are wanting the best priced life insurance policy that matches your financial objectives, at the best rate, right? Did you know that you can find this – especially if you take a few steps to better your overall health before applying? In fact, these changes can save you a ton of money each year on your life insurance with diabetes.

Your health and type of policy you need are what ultimately determines your monthly premium. Insurance companies use the medical exam to take a look at your health and determine your risk level. The better health you are in, the lower your monthly premium. It is that simple. And yes, you can still be healthy and qualify for a lower rate even if you have been diagnosed with diabetes.

Because saving money is important and so is your health, let’s discover just how easy it is to better your overall health – and save yourself some money on your life insurance policy:

Follow the instructions of your doctor. If he or she prescribes a medication or suggests a treatment – do it. And follow the doctor’s instructions exactly. They are the professional and have experience that can benefit you. After all, they take care of your health and you should, too. If a medical professional has recommended a routine test, or procedure, you’ll need to complete it before ANY company will offer. Example: If a doctor recommends a sleep study, and you put this off, companies will postpone coverage.

Incorporate a fitness routine into your daily life. Regular exercise has been proven to reduce blood pressure, increase heart health, and help regulate your diabetes. It can also reduce stress and make you feel wonderful. Getting fit increases the function and productivity of many parts of your body. Exercise doesn’t have to be boring. Find an activity that you enjoy and do it! Certain life insurance companies offer healthy lifestyle credits to those who are active, and in return offer lower life insurance premiums.

Eating a healthy, well-rounded diet can also help regulate your diabetes, lower your blood pressure, help you lose weight, and so much more. Healthy eating consists of consuming whole foods and a variety of fruits and veggies while discarding foods that are highly processed, full of sugar, or void of nutritional value.

Smoking is a terrible habit – and you know it. So, if you are a smoker, let it go. Tobacco usage is one of the biggest red flags for insurance companies. In fact, because the risk level increases so much, many smokers end up paying close to double the premiums of a non-smoker. Not to mention the increased risk of health complications smoking causes. If you obtain a policy as a tobacco user, and can quit for up to 12 months, you can always apply again for a policy in the future, that rates you as a NON Tobacco user.

Turn Your Search Over to a Personal Diabetes Life Insurance Advisor

While you are busy trying to get your health in order – managing your diabetes, following a healthy diet and exercise regime, and possibly kicking your smoking habit – why not let an independent life insurance agent take care of your life insurance search for you?

Spend time doing beneficial things for yourself, rather than wasting hours online and on the telephone obtaining quotes for policies that you may not even fully understand. Leave this search to the professionals. After all, they have connections all over the U.S. and are knowledgeable about the ins and outs of different life insurance companies who underwrite diabetics fairly, and know their underwriting guidelines toward those applicants with diabetes.

In other words, an independent life insurance agent will ask you the medical questions once and will match you with the criteria of life insurance. They will also help you with the initial application, to begin the process of applying for life insurance. If you opt to do a medical exam, and have medical records reviewed, an agent can use that information to “shop out” your case to multiple affordable life insurance company at once. This process is considered a fully underwritten policy, as the insurance companies underwriters would have completed a full review of your health profile. Once the underwriting process is completed, companies can make an offer of life insurance.

In other words, an independent life insurance agent will ask you the medical questions once and will match you with the criteria of life insurance. They will also help you with the initial application, to begin the process of applying for life insurance. If you opt to do a medical exam, and have medical records reviewed, an agent can use that information to “shop out” your case to multiple affordable life insurance company at once. This process is considered a fully underwritten policy, as the insurance companies underwriters would have completed a full review of your health profile. Once the underwriting process is completed, companies can make an offer of life insurance.

At the end of the application process, your agent will then present to you the different offers, from the various life insurance companies. This takes the hassle out of your hands and in the hands of the experienced professional. Getting diabetes life insurance doesn’t have to be a headache.

But, How Much Life Insurance Do I Need?

This is an important question to consider before you purchase your life insurance policy. Take some time to sort through all of your financial obligations and debts. Then, consider the amounts owed for things such as:

- Funeral and burial expenses

- Mortgage payments

- Auto payments

- Student loans

- Replacing your income

- Any other outstanding debt

Add these amounts together to determine the amount of debt that would be transferred on to your loved ones when you pass away. The amount of life insurance you purchase should cover this amount – at the very least.

Next, take some time to think about the answers to these questions: Are you the sole provider for the family? How much does your family rely on you for support? When you die, will your loved ones be able to afford to maintain their life while they are grieving? These are things you will need to consider since there will come a time when your income will no longer be provided to your family. To keep the financial burden and strain to a minimum, you will want to purchase enough life insurance so that your family will not have to worry. This amount will be added to the amount of your debt discussed above.

Keep in mind that failing to purchase life insurance can leave your grieving family grieving in a financial nightmare. So, start planning today. You can always start with a lower amount of life insurance, and add additional policies in the future. Always choose a trustable life insurance company over an unknown.

Life insurance with diabetes is possible to obtain and it can be affordable. And NO, it is not a complex process. Your overall health will determine the various options available. Generally, no matter what health you are in, there would be life insurance options type 1 and type 2 diabetics.

Don’t wait any longer to get your diabetes life insurance. Life can change in an instant and you won’t want to take that risk for your family. At Diabetes Life Solutions, we make the process for obtaining life insurance as easy as possible. We are the best known and affordable life insurance company. Give us a call at (888) 629-3064. The initial conversation won’t take longer than 5 to 10 minutes. We love working with the Diabetes Community, because we are apart of the Diabetes Community

Don’t wait any longer to get your diabetes life insurance. Life can change in an instant and you won’t want to take that risk for your family. At Diabetes Life Solutions, we make the process for obtaining life insurance as easy as possible. We are the best known and affordable life insurance company. Give us a call at (888) 629-3064. The initial conversation won’t take longer than 5 to 10 minutes. We love working with the Diabetes Community, because we are apart of the Diabetes Community