Chris Stocker is a financial services professional and licensed insurance agent. He's also Owner and author of The Life of a Diabetic as well as Type 1 Detour. He's been writing about Diabetes related topics for over 10 years, and has been featured in HealthLine, Diatribe, Diabetes Advocates and JDRF.. He's been writing about Diabetes related topics for over 10 years, and has been featured in HealthLine, Diatribe, Diabetes Advocates and JDRF.

Matt Schmidt

Chris Stocker

To learn about Diabetes Life Solutions commitment to transparency and integrity, read our Editorial Disclosure

Last Updated on June 14, 2025

The best life insurance for type 1 diabetes can be challenging to obtain. Now with this being said, Diabetes Life Solutions is here to help you with the entire application process. We’ll help you identify the companies that are most competitive given your financial objectives, and your overall health. From start to finish, we’ll take you through the life insurance application process, and help you navigate the diabetic marketplace.

Finding life insurance doesn’t have to be challenging any longer. We started Diabetes Life Solutions to help people with Diabetes obtain the best life insurance policies possible. Life insurance for type 1 diabetics has never been less expensive. While this is good news, insurance companies still have a ways to go to be a little more fair to the diabetes community.

Our entire website is devoted to topics pertaining to Diabetes, and also written by people who have Diabetes. WE promise that all information and quotes provided to you, will be as accurate as possible. Being the number one provider of diabetes type 1 information is something that we take pride in. We’ve spent countless hours researching life insurance providers and speaking to their underwriters to see how they would view people with type 1 diabetes in terms of underwriting them.

Sadly, many times people visit websites like Value Penguin, Investopedia, Everyday Wealth and others that contain misleading information. Those websites have articles written by freelancers, who have NO life insurance background. NOT to mention the companies they recommend are not even competitive in pricing. Please do not let yourself get tricked by misinformation provided by those who have never worked in the life insurance industry.

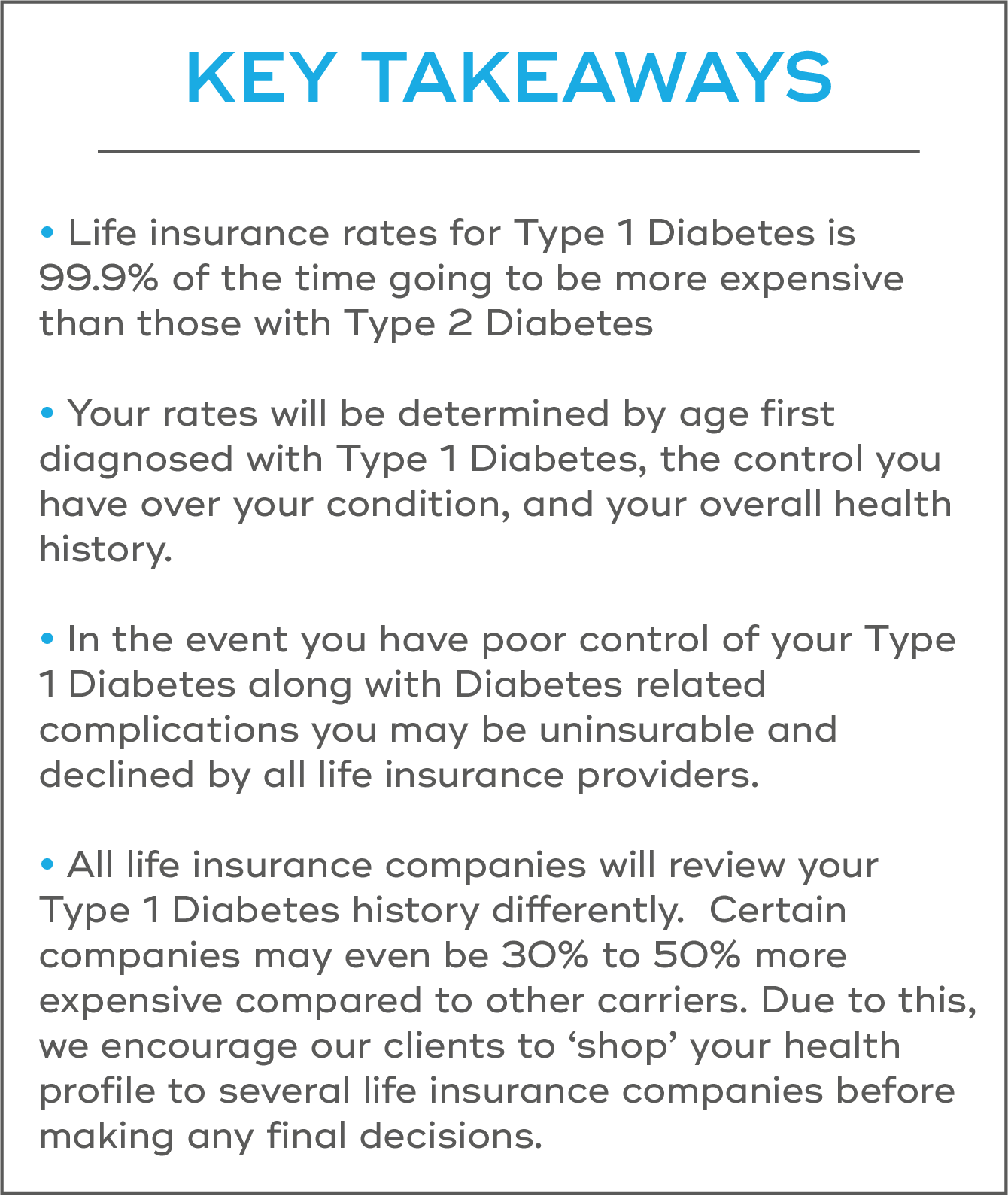

We’ll also point out that life insurance will be more expensive compared to those that do not have any type of Diabetes, or for those who live with Type 2 Diabetes. This is simply how life insurance companies are viewing Type 1 applicants. Nine out of ten times an underwriter will view you as a ‘higher’ risk compared to a Type 2 individual. While we feel this is unfair, it’s simply the reality of the situation.

Can you still qualify for life insurance? Most likely. But this is ultimately determined by your current and past health history. Is life insurance still affordable? In some situations it may very well be. Every applicant’s rates will vary depending on their complete health profile. Also, there is NO ONE BEST life insurance company. Because of this, finding coverage can be a little bit tricky.

It’s always a good idea to contact us at 888-629-3064, and speak with a licensed agent. We’d be happy to visit about your life insurance needs, and to discuss what life insurance options you may have available. Your personal situation will determine what companies, and what possible rates you’ll qualify for. We’re comfortable to say that many people may have the opportunity to still qualify for a life insurance policy. In fact nearly 90% of the people we work with are able to qualify for some type of life insurance coverage.

Quick Article Guide

Here’s what we’ll cover in this post:

- Can You Get Life Insurance with Type 1 Diabetes?

- How To Get Life Insurance with Type 1 Diabetes

- How are Premiums Priced for Type 1 Diabetes?

- What are the Best Life Insurance Companies?

- Sample Type 1 Diabetes Life Insurance Rates

- What is the Application Process?

- Frequently Asked Questions

- No Medical Exam Options

(Image Source: Gluxus Health)

Can You Get Life Insurance with Type 1 Diabetes?

Many people still have reservations about their eligibility for life insurance. Yes, yes you can qualify for life insurance. Honestly, premiums for the Diabetes community have never been less expensive. Life insurance companies have made a lot of positive changes over the last few years, that are helping people obtain policies with affordable premiums

Let us be clear. There will be a 99% chance that your life insurance policy will be more expensive, or rated as a sub-standard policy, compared to people without Diabetes. Life insurance companies are going to view your health profile as a sub-standard risk. Do not allow yourself to be tricked by unethical agents who intentionally provide you with fake quotes.

In fact, if you see a website, or agent who is showing Preferred Plus, Preferred, or Standard Plus rates, you need to know that they are intentionally misleading you. Or if you receive a quote, without providing a very detailed diabetes questionnaire, those quotes will be fake low ball quotes.

Getting life insurance with any form of diabetes can be difficult, but life insurance can still be affordable, and easily obtained. You just need to work with Diabetes Life Insurance specialists such as Diabetes Life Solutions. If you’ve been declined life insurance due to diabetes, just relax. Chances are you qualify for coverage, but you have been working with the wrong agent in the past.

Getting Life Insurance For Type 1 Diabetics

People with chronic conditions, specifically Type 1 Diabetes, did not ask for this disease, so it is unfortunate that life insurance companies look at them in a different manner. Life insurance companies will always view a person with Type 1 diabetes as a higher risk compared to a person with Type 2 Diabetes. However, life insurance companies have made improvements to their underwriting guidelines over time, and rates are at all time lows.

Fortunately, there are quite a few solutions out there when it comes to finding the best life insurance for type 1 diabetics, it just takes a little more work than it would for the average person. You don’t have to do this alone, or over complicate the matter. Diabetes Life Solutions was founded to help the Diabetes community obtain life insurance coverage. Contact us or even call 888-629-3064 and have an agent help you and your family.

The best way to determine which life insurance companies will approve is to do the following:

- Request a quote and information

- Share your Diabetes history with a licensed agent

- Allow an agent to provide various life insurance options, bdased on your specific health profile

- Work with an agent to take you through the entire application process

How are Premiums Priced for Type 1 Diabetic Life Insurance

The first and most important thing to understand, is that your life insurance is going to be more expensive than life insurance for non-Diabetics. There is simply no getting around this fact – diabetes is a disease that the life insurance underwriters are going to view as a risk and they adjust premiums accordingly. There is no way to hide eType 1 Diabetes from them either, as you’ll have to provide details to your Diabetes treatment and history on the application.

For most people who have Type 1 Diabetes, your policy will be ‘Table Rated’ or rated Sub Standard. This means that your life insurance policy will be more expensive, compared to a person without Diabetes. We completely understand how frustrating this can be, as we view people with Diabetes Type 1 to usually be very healthy. However life insurance companies are always going to view you as a higher risk.

Generally, every table rating applied to a policy, increases the premium by 25%. Majority of people looking for life insurance policy issued with a table rating of C,D or higher. Everyone’s health profile, and diabetes history is different. For an accurate quote, you’ll need to complete a brief diabetes questionnaire, or contact us.

Life insurance companies are going to base your premium off of six main criteria:

- Age of Type 1 Diabetes onset

- Control of your Type 1 Diabetes (A1C and Glucose history)

- Other Significant Health issues

- Usage of Tobacco Products

- What Type of Diabetes treatment are you Receiving

- Your Age at Time of Application

INSIDER’S TIP: Less than 5 percent of all policies applied for by Type 1 diabetics will be STANDARD. Majority of applicants will be Table Rated. Unfortunately, certain websites and agents try and trick the Diabetes community. If an agent emails you a quote using Standard or better ratings, they are intentionally misleading you, to trick you into applying with them.

Also, if an agent quotes you Fidelity Life, Protective Life or Prudential, and indicates they have the lowest rates possible, 99% this in fact FALSE. While both carriers are excellent life insurance companies, there are generally better priced options. Only agents who are not properly trained in working with the Diabetes community, quote these companies.

about your health profile. As an example, you maintain an active lifestyle, exercise regularly, and eat rather healthily. For whatever reason, you struggle to keep an A1C below 8.0. Share this with us.

On a case by case basis, an Underwriter could still possibly assign healthy lifestyle credits to your policy. These credits would help lower the cost of life insurance.

Remember, all Life Insurance Companies Will View You Differently

Rates on life insurance for type 1 diabetics can also vary wildly from company to company. This is because every life insurance provider assesses risk in a different way. While one might see Diabetes to be a huge risk, another may have many customers who are Diabetic and as a result is able to offer lower rates to Diabetics.

There is no “super list” out there that breaks down which companies you should apply with depending on your condition – however, depending on what type of policy you are looking for, we most certainly have some knowledge as to WHAT companies would work best for you!!

At Diabetes Life Solutions we specialize in helping type 1 diabetics get the best insurance rates. We only work with the Diabetes community. This is all we do, every day of the year.

Since we are only working with the Diabetes community, we are familiar with the companies that will treat your condition the most favorably and how to set yourself up for success in getting the best life insurance rates. We will work with you to get the best life insurance for your needs.

One company may rate you higher due to past medical history, Height / Weight, or current control of your Type 1 Diabetes, while another company may not have any problems with this. Or maybe you have a form of Diabetes complication that would make you uninsurable with one company, where another one would approve you. That’s why it’s imperative to work with an agent who only works with the Diabetes community. One that’s trained properly, to know all the ins and outs of various life insurance companies.

To begin determining what options you may have, simply reach out to us. Complete the quote request, or call us at 888-629-3064. A quick 5 minute phone call is all it usually takes. If wanting to find a policy with the lowest rates, you will want to work with an independent life insurance agent. They will have the ability of ‘shopping’ out your health profile to various companies, to determine what the final offers of coverage will be. This is the exact thing we do, for our clientele.

To begin determining what options you may have, simply reach out to us. Complete the quote request, or call us at 888-629-3064. A quick 5 minute phone call is all it usually takes. If wanting to find a policy with the lowest rates, you will want to work with an independent life insurance agent. They will have the ability of ‘shopping’ out your health profile to various companies, to determine what the final offers of coverage will be. This is the exact thing we do, for our clientele.

It is also worth noting that there are other forms of life insurance which are available and can even be dead simple for diabetics to obtain. One example of this is what they call burial insurance – a life insurance policy that doesn’t care about your health and pays out a fixed amount in the event of your death.

Policies like these are perfect for individuals who only need a small amount of insurance, to address final expenses and funeral costs. If you are looking at policies like these, then we’ll want to focus on specific burial insurance providers.

There are many other options like whole life insurance for diabetics, term insurance, and other guaranteed issue plans. If unsure of what type of life insurance you need, just reach out to us. An agent can review your situation, and make suitable recommendations. Most individuals with Type 1 Diabetes can obtain any type of life insurance that’s on the marketplace. Rarely will the diabetes prevent you from qualifying for one type of policy or another.

This is another reason why working with an agent to get life insurance for type 1 diabetes can help you find the right match for your needs. Here at Diabetes Life Solutions, we will only provide REAL and ACCURATE information to you. NO fake quotes will be provided, unlike other online websites.

What Life Insurance Companies may be Ideal with Type 1 Diabetes?

Without knowing a person’s complete health history, it will be nearly impossible for any agent to recommend any one specific life insurance company. Again, it’s highly recommended to contact us, and provide the necessary medical information in order to receive a real and accurate life insurance quote.

Companies listed below may be ideal, or there might be others that are better suited for yourself. We can only identify the BEST companies once you request a quote, and share with us your detailed diabetes history.

Certain websites often advertise that life insurance companies like Mutual of Omaha, Prudential, or even Protective Life as being the best options for type 1 diabetics. This is simply not the case. It’s not that these companies are ‘bad’ life insurance providers, rather they are simply more expensive then other companies.

Here are some sample companies that MAY be the best fit for you:

AIG or American General Life Insurance Company offers Term Life Insurance, Universal Life Insurance products, and Whole life policies to clients with Type 1 Diabetes. They also continue to have strong financial rankings.

AIG Life and Retirement, the division responsible for the company’s life insurance policies, has earned:

- A – A.M. Best

- A+ – Fitch

- A2 – Moody’s

- A+ – Standard & Poor’s

Banner Life has over a 180 year experience in the life insurance industry. They may consider Term Life, or a form of Universal Life insurance to a person with Type 1 Diabetes. Banner Life is rated A+ on A.M. Best for their superior performance and Financial Strength

Foresters is a company that a lot of people are not familiar with, but probably should be. They were founded in 1874, and other products to the Type 1 Diabetes community. This includes Term Life Insurance, Whole Life Insurance, and Guaranteed Universal Life policies.

Foresters is considered to be a strong and stable company from a financial standpoint. Because of this, it has been given high ratings. For example, A.M. Best has rated Foresters as an A- (Excellent).

John Hancock Life insurance company was initially founded back in 1862. John Hancock was one of the four-person founders. Ove time, John Hancock life insurance company has grown into one of the largest life insurance organizations in the United States. They are currently offering Term Life Insurance, and Universal Life Insurance products to people with Type 1 Diabetes.

Due to its healthy financial position, as well as its positive reputation for paying out to its policyholder claims, John Hancock is very highly rated.

These ratings include the following:

- A+ from A.M. Best – Superior (the second highest out of a total of 13 ratings)

- AA- from Fitch Ratings – Very Strong (the fourth highest out of a total of 19 ratings)

- A1 from Moody’s – Low credit risk (the fifth highest out of a total of 21 ratings)

- AA- from Standard and Poor’s – Very strong (the 4th highest out of 21 total ratings)

Assurity Life Insurance Company has been in business well over 100 years. They were founded all the way back in 1890. This makes them one of the oldest life insurance companies in America.

According to a recent Gallup Poll, Assurity Life Insurance Company has also been ranked in the 91% of all life insurance companies in the Gallup survey when it comes to employee engagement.

Assurity Life Insurance Company currently offers Term Life Insurance, Whole Life Insurance, Universal Life Insurance, and Accidental Death products to people with Diabetes Type 1. They also hold an A+ rating with A.M. Best.

![]()

Mass Mutual has been in business since 1851. As the name implies, they are a ‘mutual’ insurance company and do not have any stock holders.

In addition to paying death claims in a timely manner, they are financially solvent with the highest ratings possible.

- A++ (Superior) from A.M. Best Company. This is the highest possible rating out of 15 total.

- AA+ (Very Strong) from Fitch Ratings. This is the second highest possible rating in a total of 21.

- Aa2 (Excellent) from Moody’s Investors Services. This is third in a total of 21 possible ratings from Moody’s).

- AA+ (Very Strong) from Standard & Poor’s. This is the second highest rating out of 21 total).

Mass Mutual will consider those who have a type 1 diabetes history for term, and permanent life insurance products. To qualify, an applicant will have to undergo the underwriting process.

Symetra Life insurance company is yet another company that will consider a type 1 individual for coverage. They have been in business since 1957. Symetra has very solid financial ratings as you’ll see below.

- A (Excellent) from A.M. Best. This is the 3rd highest rating out of a possible 16.

- A (Strong) from Standard & Poor’s. This is the 6th highest rating out of a possible 21.

- A2 (Good) from Moody’s Investor Services. This is the 6th highest rating out of a possible 21.

- A (Strong) from Fitch. This is the 6th highest rating out of a possible 19.

Depending on your overall diabetes and health profile, you may qualify for term or permanent life insurance coverage through them.

Midland National is a pretty good life insurance provider, that many people have never heard of. For some people with type 1 diabetes, they could be the perfect fit. Midland National’s proud history dates back to our founding, in 1906, under the name Dakota Mutual Life Insurance Company.

Here’s a quick look at their financials, which are some of the strongest in the industry:

- A.M. Best Superior A+ rating

- S&P Global Ratings A+ rating

- Midland National has an A+ rating with Fitch Ratings

At this time, Midland National will offer term and permanent life insurance products on a case by case basis for those living with type 1 diabetes.

While the above is a list of companies that may be the best for you, again it’s imperative to share your profile and financial goals with an agent. Your specific situation will help us determine what company may be ideal for you.

How Much Does Life Insurance with Type 1 Diabetes Cost?

While life insurance rates will vary from person to person, we do want to illustrate some sample rates. These rates are for Non Tobacco users, who have good control of their Diabetes, and no other significant health issues.

Actual rates are determined by an individual going through underwriting. In some cases, your ‘real’ life insurance rates could be lower then what’s shown below.

Life Insurance Rates for Type 1 Insulin-Dependent Diabetics

Age | ||||

|---|---|---|---|---|

Age | ||||

|---|---|---|---|---|

What is the Application Process with Type 1 Diabetes?

For about 75% of applicants who have Type 1 Diabetes, you’ll need to complete a fully underwritten life insurance policy. This means that you’ll need to complete a basic application, complete a paramedical exam, and also allow underwriters to review your most recent medical records. Usually only the last four to five years worth of records are ordered and reviewed.

A basic insurance application for a person with Diabetes would ask for the following:

- Full Name

- Date of Birth

- Address

- Driver’s License Number

- Social Security Number

- Occupation and Employer

- Annual Income and Net Worth

- Medical History Questions

- Name and Address of your Medical Professionals

When applying, you simply would complete an initial application. Complete a blood/urine exam, and then have your agent order your most recent medical records. Once the health records are received, along with your lab results, life insurance underwriters can review your complete health profile. All this information will be used for companies to make an offer.

While applying, you are NOT locked into any term length, or amount of life insurance. Since nobody can determine what final rates you may qualify for, you can make final decisions with the final offers. When applying thru Diabetes Life Solutions, there’s no need to complete multiple exams, or have your doctor office make multiple copies of records. Your agent will handle all of this on your behalf.

Frequently Asked Questions

Q: Why are life insurance rates for people with type 1 diabetes more expensive?

A: Majority of life insurance companies simply still view a person with type 1 diabetes as high risk to insure. Even though we know that you can live a very healthy life with diabetes, companies will rate you higher. That’s the unfortunate thing. Carriers fear some of the longer term types of complications that may come from type 1 diabetes, such as retinopathy, neuropathy, or even nephropathy.

Q: Am I limited to any type of policy, or riders for my policy?

A: Surprisingly, no you are not. Companies have evolved for the better over time. You would most certainly be able to choose from Term Life Insurance, and various types of Permanent Life Insurance. People with life insurance with type 1 diabetes can have policies with the same types of riders as a person without diabetes. Depending on your health profile, you may even qualify for policies with living benefit riders which have become extremely popular over the years.

Q: Do I have to do multiple medical exams, to determine my exact life insurance rates?

A: Great news! You can generally simply do one paramedical exam, as insurance companies will accept the lab results, and medical history information collected at time of exam. This saves you from having to do multiple tests and scheduling countless appointments.

Q: Do I have to have an A1C of 7.0 or below, to qualify for life insurance?

A: Sadly, this is yet another myth. We do always recommend a person tries to control their diabetes levels to the best of their abilities. But NO, an A1C of 7.0 is not needed to qualify. In fact, a couple of companies may consider a person with readings as high as 9.5.

Q: I’ve been declined for life insurance due to my type 1 diabetes, will this impact my options for life insurance?

A: No, it won’t. Life insurance underwriters are going to view your health profile at time of applying. Even though you were declined in the past, they are going to look at your health profile with an open mind. As long as you fit their underwriting guidelines, they will offer coverage. You could be declined 100 times in the past, and still be approved, if you medically qualify.

No Medical Exam Life Insurance Options for Diabetics Type 1

Anotherlife insurance option is a no medical exam policy, which could be a great option for some type 1 diabetics. These plans are going to give you the life insurance protection that you need, without being required to take the medical exam.

Truthfully, there are not a lot of no medical exam options for people with Type 1 Diabetes. However if you’d like to discuss what options you have available, simply contact us, and speak with an agent. It will be a little tricky to qualify. Now some good news. For certain applicants, non medical exam policies may provide the same if not better rates compared to going through an examination process.

If you qualify for a no medical exam policy, here is how companies will determine your eligibility:

- Results of a Medical Information Bureau review

- Prescription drug background check

- Answers to basic health and Diabetes questions

- Additional lifestyle information provided by your agent

Another type of non medical exam option now presented to type 1 diabetics requires you to complete a basic application, and allow companies to review the last 4-5 years worth of medical records. The health information in your records would determine your eligibility, and final rates.

For many applicants, a plan like this may make sense. Especially without having to deal with the inconvenience of completing a paramedical examination. It’s very possible that you have had a recent appointment with your Doctor, and they completed blood work. These recent notes in your records may be sufficient to obtain offers of life insurance coverage.

There are several advantages and disadvantages to these plans that you should be aware of when looking to get life insurance.

Advantages of No Medical Exam Policies

One main advantage of policies like these, is they can be approved in a matter of days. For people who need life insurance for a SBA Loan, or Divorce obligation, these policies may be a good fit. If needing coverage in matter of days, this would be your only option.

Another advantage is certain companies don’t ask about A1C readings, and may have more liberal Height and Weight chart. Often times a no medical exam policy could come back at a lower price, compared to a fully underwritten policy.

If you aren’t too fond of a company going thru your medical records, or reviewing your results from blood work, non medical exam policies would be your best bet. Or if you wish to obtain coverage in a quicker manner, not completing an exam would suit your needs better.

Disadvantages of No Medical Exam Policies

Just like with every other type of life insurance coverage, there are going to be some disadvantages to life insurance plans. The biggest pitfall is that they may be more expensive. Now this isn’t always the case, as for some individuals a non medical exam policy may be less expensive.

With a traditional plan that requires a medical exam, the insurance company gets an idea of what your health is, which means they can calculate how much risk you are to insure. With no medical exam plans, they don’t get that complete picture, which means they are going to take on more risk with the insurance policy. Companies can only collect so much information, using MIB and prescription background checks.

In the event you’re applying for a policy that requires a review of medical records, then insurance companies will know exactly what type of overall health you are in. They’ll be able to review all the notes and history of your Diabetes check ups.

Another disadvantage is that non medical exam policies are not available to everyone. Depending on your age of Diabetes onset, your options may be rather limited. Simply contact us, to discuss your options. Depending on your overall health profile, we’ll be able to share with you all the possible life insurance options available to you. Not everybody will be able to qualify for coverage without doing a paramedical examination.

Comparison of Type 1 and Type 2 Diabetes

How To Proceed and Determine Final Rates

Due to having Type 1 Diabetes, you will NOT know what final rates and offers you’ll qualify for, until you actually apply for coverage. You’ll need to speak and communicate with an agent, to begin the application process. To begin, simply complete a quote request on this page.

After speaking with an agent, they’ll be able to recommend a non medical exam policy, or a fully underwritten policy. From there, they can begin the application process with you.

Once final offers are determined, your agent will present them to you. At that point you can decide what insurance company, and amount of life insurance to move forward with. When working with Diabetes Life Solutions, you are not locked into any policy or amount while applying for life insurance.

Diabetes Life Solutions was founded to help the Diabetes community with their life insurance needs. We’ve helped thousands of individuals with diabetes. Use our expertise and services to secure the best policy for your family.

So, just because you have diabetes doesn’t mean you are uninsurable, it just means you just have to work with the right agency, such as Diabetes Life Solutions.. Don’t let your family’s future go unprotected for any longer, take out a life insurance policy today with Diabetes Life Solutions.

If you have any questions regarding your life insurance, please contact one of our agents today. We would be happy to answer those questions and ensure that you’re getting the best plan to meet your needs at an affordable rate.

Because you never know what’s going to happen tomorrow, you shouldn’t wait any longer to get the life insurance protection that your family deserves. Not having diabetic life insurance is one of the worst mistakes that you could make.

We know that getting life insurance as a diabetic can be a stressful and difficult process, but it doesn’t have to be. Our agents are here to make the process as quick and simple as possible.

Our agents have years of experience working with type 1 diabetics and can give you the lowest insurance rates for quality policies. When you work with us, you’re only going to receive honest, and accurate information from us. You won’t get the ‘bait and switch’ tactics other agent employ. Call us at 888-629-3064.

Life insurance is the best safety net that you can buy, don’t wait any longer to get the protection that they deserve. Contact us today to receive your free quote.

Find out how much life insurance with Diabetes Life Solutions costs

Matt Schmidt

Matt Schmidt is a nationally licensed diabetes insurance expert. Over this time frame he's helped out over 10,000 clients secure life insurance coverage with Diabetes. He's frequently authors content to Forbes, Entrepreneur, The Simple Dollar, GoBanking Rates, MSN, Insurancenews.net, and Yahoo Finance and many more.

Matt Schmidt is also the Co-Founder of Diabetes Life Solutions and Licensed Insurance agent. He’s been working with the Diabetes community for over 18 years to find consumers the best life insurance policies. Since 2011, he has been a qualified non-member of MDRT, the most prestigious life insurance trade organization in the USA