Chris Stocker is a financial services professional and licensed insurance agent. He's also Owner and author of The Life of a Diabetic as well as Type 1 Detour. He's been writing about Diabetes related topics for over 10 years, and has been featured in HealthLine, Diatribe, Diabetes Advocates and JDRF.. He's been writing about Diabetes related topics for over 10 years, and has been featured in HealthLine, Diatribe, Diabetes Advocates and JDRF.

Home » Life Insurance for Gestational Diabetics in 2025

Life Insurance for Gestational Diabetics in 2025

Matt Schmidt

Chris Stocker

To learn about Diabetes Life Solutions commitment to transparency and integrity, read our Editorial Disclosure

Last Updated on June 14, 2025

Gestational Diabetes is usually a temporary type of diabetes that occurs during 18 percent of pregnancies, however, studies show that people who develop this condition are more at risk to develop Type 2 Diabetes later on in life. At Diabeteslifeinsurance.com we will walk you through the process and help you obtain life insurance with gestational diabetes.

You must be wondering if there are any options with gestational diabetes. The answer is a big yes! Being a mother, you always want the best for your child, and life insurance is one of the best options you could have for your child. We are here to help you chose the best life insurance options for your particular situation.

What does it mean when you are trying to get life insurance with Gestational Diabetes? Here’s a hint, it may not impact your rates at all! Many times life insurance can be obtained with NO extra premiums, or higher ratings. When working with Diabetes Life Solutions, we’ll make sure to recommend specific life insurance companies that will not rate you the same way as a person with Type 2 Diabetes. Sadly, certain companies view Gestational Diabetes the same way as Type 2 Diabetes.

Finding the best term life insurance with no extra premiums can be quite a challenging task. More hard work and efforts are required to find the best agent.

If you currently have or have a history of Gestational Diabetes, you’ll want to work with experts like Diabetes Life Solutions in regards to your life insurance needs. Working with the wrong agent may lead to you paying more for your coverage, than is truly necessary.

However, before life insurance approval, underwriters examine various risk factors. For instance, if a person already has a history of gestational diabetes, a medical exam will be conducted for the same. But this is not the case when working with Diabetes Life Solutions. We offer you the best term life insurance with no extra ratings or premiums. If you really want to achieve the best rates, the only way is to work with someone who deals with the diabetes community. And this can only be possible in the case of Diabetes Life Solutions.

.

Gestational Diabetes and Type 2 Diabetes Rick Factor

When getting best life insurance with gestational diabetes, the insurance underwriters know that Type 2 Diabetes is not one that they are born with but that manifests over time with their lifestyle choices. Risk factors are taken into consideration when a life insurance underwriter takes on your case. If you have had Gestational Diabetes you are more likely to get Type 2 Diabetes, however, if you go on to live a healthy lifestyle you are far less likely to develop Type 2 Diabetes.

Life insurance companies obviously prefer to offer life insurance to people in good health, and who have not had treatment for any type of Diabetes. But rest assured if you have had Gestational Diabetes, it is NOT the end of the world. Finding affordable life insurance will probably be easier than you think.

Life Insurance Factors

Please note that there are many factors that go into diabetes and some can be hereditary and not related to living an unhealthy lifestyle. Your history is just one piece, of the puzzle. Life insurance companies will want a snapshot of your complete health profile.

Here are some sample questions companies offering best life insurance will ask you specific to your history of your health history:

- Any history of Diabetes complications such as Retinopathy, Neuropathy, or amputation due to Diabetes?

- What is your most recent A1C and Glucose reading?

- Are you compliant with your Doctor’s treatment for your Gestational Diabetes?

Another factor to consider when getting term life insurance is your family history. Many insurance underwriters consider is your family history as a guideline for you. If you have a family history of diabetes in your family tree you are more likely to pay a higher rate. Most life insurance companies will also want details of your treatments. So be prepared to provide details.

Life insurance underwriters look at many other factors if you are suspect to a family bloodline of diabetes or have been previously diagnosed with Gestational Diabetes. Now that you are on their radar for health problems they want to look at your overall health at the current moment.

Questions Underwriters May Ask

• What is your blood pressure like? Is it high? Low?

• Is your cholesterol good or bad?

• What is your height and weight?

• Do you watch your diet?

• Do you exercise regularly?

• What was your last A1C reading?

• Do you use alcohol and tobacco products?

• What medications to you take?

• Do you participate in any high-risk activities?

• Do you have a dangerous occupation?

They might even ask you about your travel history. We have seen people be denied in the past for traveling to certain countries frequently. Our agents are trained to work with you, and to recommend specific life insurance companies that will accept your risk profile.

What are the Costs of Life Insurance with Gestational Diabetes?

Now you are probably wondering, “Am I going to have to pay an arm and a leg to get life insurance?” Or, “can I even get life insurance?” Honestly, that question may have ZERO impact on your rates and life insurance options.

As you know, Diabetes can be controlled with a proper diet and exercise. The main concern life insurance companies will have is the potential for a woman with gestational diabetes to develop type II diabetes later in life. You will want to wait about 6-8 weeks after birth to apply.

Life Insurance companies will want to make sure the delivery of your child went as smoothly as possible. They will also want to be sure there were minimal or NO complications during the delivery process. It’s generally smart to also begin to lose some pregnancy weight before applying. Life insurance carriers are aware that you won’t be at pre-pregnancy weight, but your agent can always relay this information to an underwriter.

You can can qualify for the same types of life insurance policies that people without a history of diabetes can obtain. This includes whole life insurance, term life insurance, guaranteed universal life insurance and variable life insurance policies You will also be able to have policies with various life insurance riders, and living benefit riders as well.

In most cases, you will receive a Standard to Preferred rating from carriers. Essentially meaning no extra ratings, for having been treated for Gestational Diabetes. Now, if your condition was moderate to severe, you may pay ‘extra’ premiums depending on your complete health profile. Worst case scenario is you are declined all together. It’s extremely important to speak with an agency such as Diabetes Life Solutions, before applying for life insurance. We’ll provide you honest advice and will even let you know if you should apply at all, now.

Do I have to do a Medical Exam?

Before getting insurance, it’s important to make sure the agent you’re working with has great knowledge of the diabetic life insurance industry as a whole. Are any medical exams required? No!!! You do not have to do a medical examto be approved for coverage. Generally, there are several options for non-medical exam policies. To find out what your various options are, simply contact us, provide us with your basic health profile, and we can share with you all the options you’d be eligible for. The initial phone call takes 5 minutes or less.

If you qualify for a non-medical exam policy, the application process for gestational diabetes life insurance may take 2-3 days. These types of plans are underwritten in a much quicker time frame, then traditional life insurance policies. However, they may be more expensive, compared to policies who test your blood and urine. Good news is, you can always begin with a policy like this, and in the future, reapply for a policy that may provide a better rate.

Work with Independent Agents

The best way to make sure you’ll receive the best rates is to work with an agent who ONLY WORKS with the Diabetes community. Many agents advertise that they specialize in working with people with Diabetes, but when you look at their website, those agents seem to specialize in HUNDREDS of other types of niches. You need to make sure your agent is knowledgeable on diabetes and gestational diabetic life insurance policies, so you are getting the best possible rates.

If you are pregnant and want to protect your family, get a free quote from the experts at Diabetes Life Solutions. We can help you compare quotes from top-rated life insurance companies and find the company that best fits your needs.

That’s what we do. We specialize in only working with people who live with diabetes.

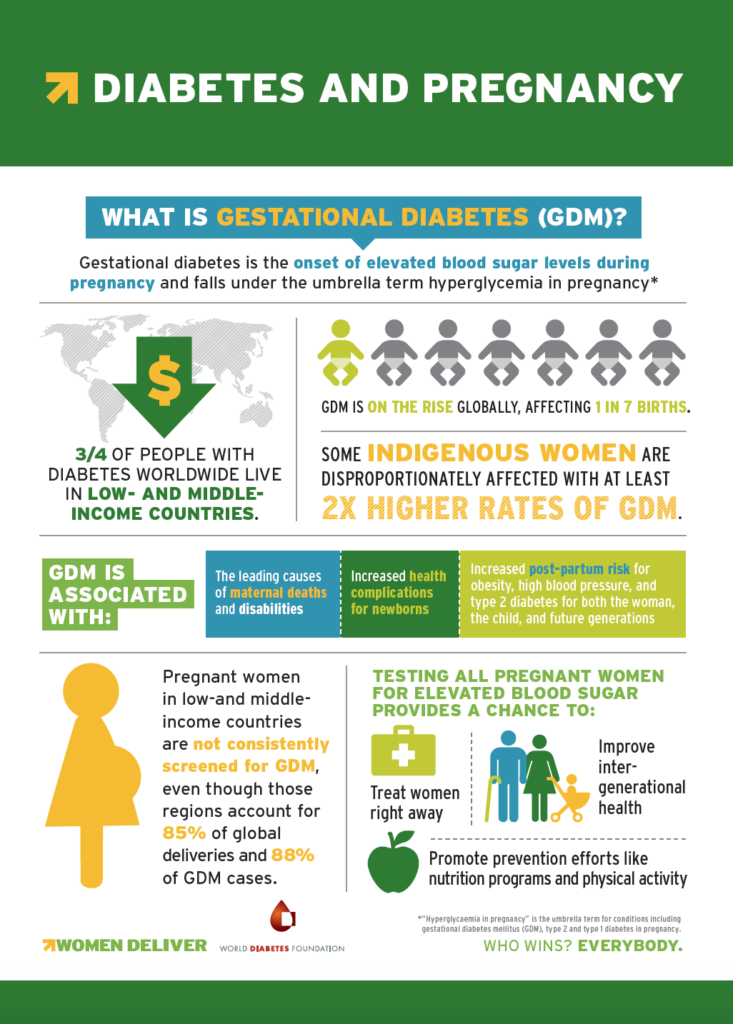

Source: Women Deliver

Calculating Life Insurance Needs

When calculating what life insurance policy, you should get, you should look at a few different things. Our agents are standing by to discuss important issues like this with you.

One item to calculate is your amount of debt. Having enough from your life insurance payout to help pay off your debt is important to your family. This can include mortgages, credit card debt, student loans, or any other type of significant debt you may have.

Some calculate the costs of funeral expenses, however, burial insurance is a much better way to plan for unexpected funeral costs. Most funerals may cost $10,000 to $20,000 these days, and many people don’t think about how to have these types of expenses paid.

You will also want to add in your annual salary. This is how much you get paid each year because if something were to happen to you, your family is left without your money to help support them. This is critical and needs to be taken into consideration. As an example, Dave Ramsey recommends Ten Times your Annual Salary, at a minimum.

In certain situations, a person with Gestational Diabetes may need life insurance to meet a divorce obligation, or for a SBA loan. Our agents will be able to help you find the right policy, to meet these unique needs.

Many people make the mistake of getting a lower amount of life insurance and it leaves behind a mound of debt for the family to pay off which can cause many problems. If you don’t provide your family with the proper amount of life insurance, they may not be able to maintain their desired life style. As with all types of Life Insurance, if you no longer need the coverage, you can cancel the policy at any time.

Don’t give up looking at life insurance just because you have gestational diabetes! Whether you need Term Life or a Guaranteed or Universal Life policy, we can make sure your life insurance is affordable, and that you get the best rates available.

If you have any other questions, please call or email us right away. We love to work with the Diabetes community and are here to serve. Not all life insurance companies look at people with Gestational Diabetes the same. Since we are the ONLY agency who ONLY works with people with Diabetes, we know what companies ARE BEST FOR DIABETICS. A 5-minute phone call to 888-629-3064 is all that it takes, to start receiving information based off your health profile, and financial situation.

Matt Schmidt

Matt Schmidt is a nationally licensed diabetes insurance expert. Over this time frame he's helped out over 10,000 clients secure life insurance coverage with Diabetes. He's frequently authors content to Forbes, Entrepreneur, The Simple Dollar, GoBanking Rates, MSN, Insurancenews.net, and Yahoo Finance and many more.

Matt Schmidt is also the Co-Founder of Diabetes Life Solutions and Licensed Insurance agent. He’s been working with the Diabetes community for over 18 years to find consumers the best life insurance policies. Since 2011, he has been a qualified non-member of MDRT, the most prestigious life insurance trade organization in the USA

Find out how much life insurance with Diabetes Life Solutions costs