Last Updated on February 24, 2026

Term Life Insurance for Diabetics

Term Life Insurance for Diabetics

You know how important life insurance is or else you probably wouldn’t have found your way here. Dying is a part of life so when it is your turn, you want to make sure that the loved ones you leave behind are taken care of. But, when it comes to medical conditions such as diabetes, finding affordable life insurance can be difficult.

For many people, the best term life insurance for diabetes is the best type of life insurance coverage. Term coverage is the least expensive type of life insurance, a person can purchase. There are many types of policies a person with diabetes can purchase, and the life insurance market place can be tough to navigate. Let Diabetes Life Solutions make this process simple and as easy as possible for you and your family.

We have some good news for you. You can receive term life insurance with diabetes – even with your history of diabetes – at an affordable rate. You just need to know how. And, that is where we come in. Since we only work with the Diabetes community, we are able to help you navigate the term life insurance for diabetes marketplace.

First, let’s start with the basics.

What is Term Life Insurance? How Does It Differ?

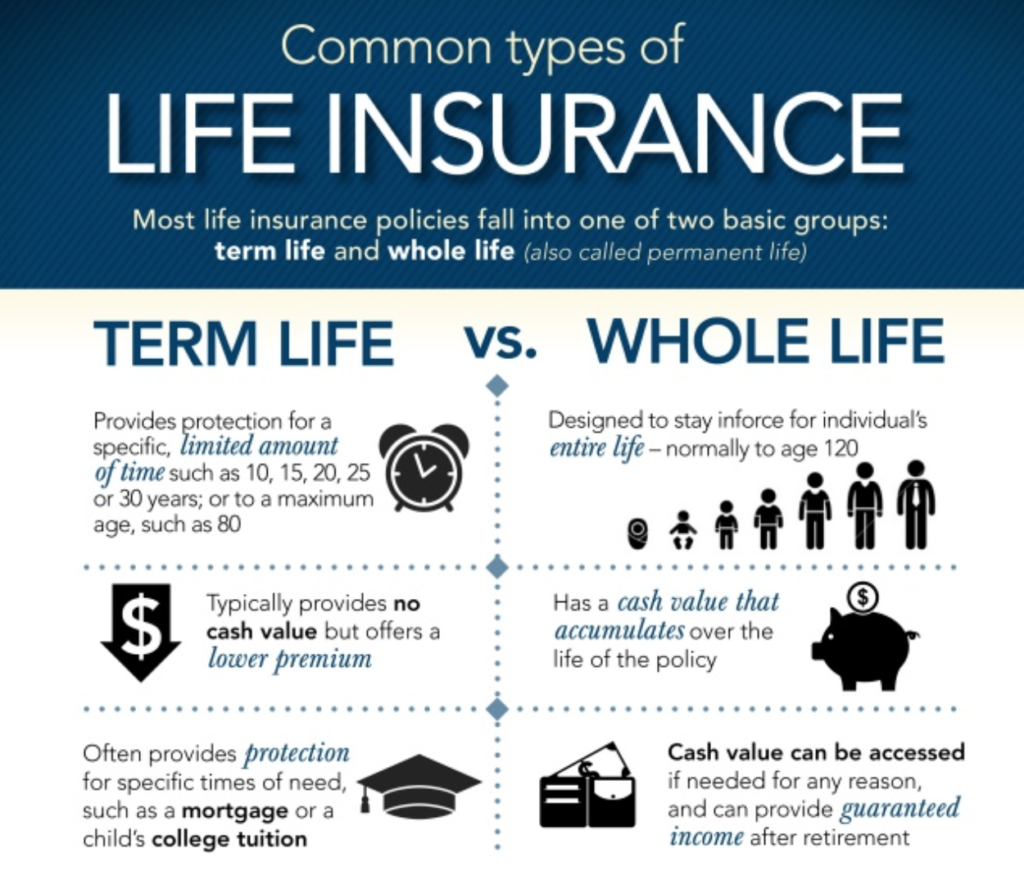

Term life insurance is called such because it is insurance that you purchase for a specific term duration. You will have a selection of term periods to select from. Then, once you begin paying your premium, your policy is in effect. It will remain that way until the term period is up. Premiums are level and, once the initial guaranteed term is up, you can cancel the policy, possibly convert the policy to a permanent plan, or accept an annually renewal term plan.

If you have prediabetes,gestational, type 1, or type 2 diabetes, you should be eligible for the various best term life insurance for diabetes plans on the market place. Depending on your health profile, you may even be eligible for diabetes non medical exam policies. When working with us, we’ll provide you with REAL and ACCURATE quote and options, based off your health profile. Diabetes Life Solutions was founded to help the diabetes community with their term life insurance for diabetes needs. We have been where you are at one point. And understand the Diabetes Life Insurance market place.

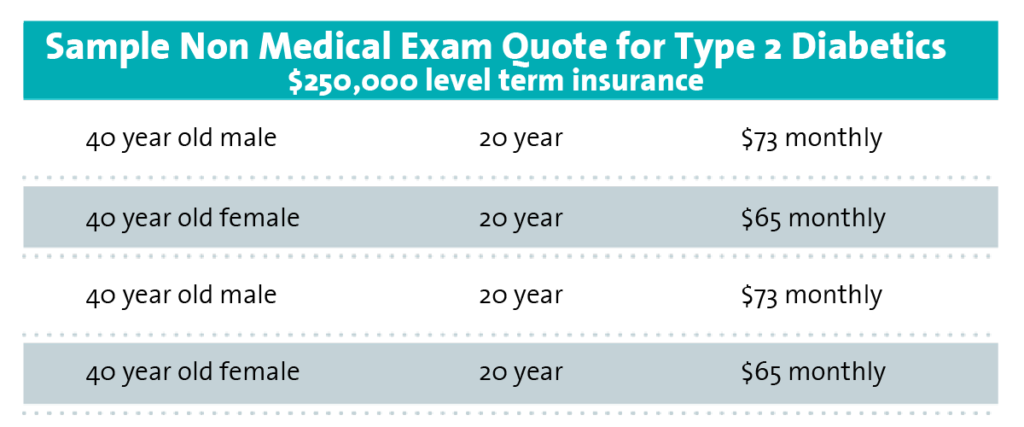

Here are some sample non medical exam options:

Different from term life, whole life insurance provides you with coverage for as long as you pay your premiums. It is in place for your whole life; it is permanent. Because underwriters know that they will most likely have to pay out a claim on a whole life policy, they tend to look for policyholders of great health – thus reducing the risk of having to pay out anytime soon. This makes it difficult for those with medical conditions such as diabetes – or any pre-existing conditions – to obtain a whole life policy.

It is not impossible to qualify for coverage. And there are certain life insurance carriers who are “diabetes friendly” . When working with us, we’ll help you determine what companies are ideal, given your health profile. If you have type 1 diabetes, there’s a good chance you may pay higher premiums when compared to someone with type 2 diabetes.

Often times permanent life insurance such as whole life insurance, or guaranteed universal life insurance, will have underwriting guidelines that are more favorable to people with diabetes, compared to term life insurance for diabetics. If you have a recent history of heart attack, strokes, treatment for cancer, or other significant health issues, then guaranteed issue whole life insurance may be your only option.

What are the Benefits of Term Life Insurance?

After reading about what best term life insurance for people with diabetes is, you may be thinking that it really does not sound appealing because – after the term – you will be left with no insurance. However, there really are some great perks to choosing this type of life insurance.

When the term is up, many insurance companies offer you the opportunity to roll your coverage into a whole life policy. This may or not be the case due to your medical conditions, but the possibility of the offer can make term life more enticing.

Just about everyone can purchase term life insurance. Those who are younger or those in good health may pay a much better premium than those who are not, but it is still attainable by almost everyone – including diabetics.

Term Life insurance can be ideal if you have a mortgage, student loan debt, or providing life insurance until you child is grown up.

For the length of your term, you will have exceptional coverage. No matter when you die during the term of the policy, the payout to your beneficiaries will always be the same.

Most policies are not subject to federal income taxes.

Term Life Insurance is ideal for meeting obligations of a Divorce settlement, or SBA loans.

The death benefit and the premium cost remain the same for the length of the term.

You select the length of the term you want. For example, you can choose to have your term life policy for 5, 10, 20, 30 years and such. As long as you continue to pay your premiums, you will have coverage for the entire length of that term.

You select the length of the term you want. For example, you can choose to have your term life policy for 5, 10,15, 20, 25, 30, 35, 40 years. As long as you continue to pay your premiums, you will have coverage for the entire length of that term. If not needing the life insurance any longer, you can simply cancel the policy. There is NO obligation for you to carry the policy, if you do need the coverage.

While these are just a few benefits that come with best term life insurance for people with diabetes coverage, you will want to seek out insurance companies that are more friendly toward diabetics (or those with other medical conditions) in order to obtain the best policy.

Diabetics and Term Life Insurance

If you are a diabetic and you have tried to obtain life insurance, then you may have found that it is quite a bumpy road. Now you know that best term life insurance for diabetics is generally an easier option for diabetics to obtain coverage. But as you set out on your quest for coverage, it is important to know that some companies are more lenient towards those diagnosed with diabetes or other medical conditions – other companies, not so much. Often time, insurance companies feel that agreeing to insure someone with health concerns is too great of a risk.

With the best term life insurance for diabetics, you have the liberty to shop around and obtain quotes before agreeing to insure with any particular company. We will pitch your complete health profile to the various life insurance companies on your behalf. Simply give us a call at (888) 629-3064 and speak with an agent, who’s educated on life insurance and diabetes. Once we have an idea of your overall health, we can share with you multiple quotes, from several life insurance companies.

The bad news is that this is a lot of tedious, monotonous, and time-consuming work. Thankfully, independent agents like ourselves are skilled in the process and have it streamlined to make things a bit easier. We also have connections throughout the industry – and a plethora of knowledge. All of the combined can give you the easiest route to finding the most affordable life insurance that offers the best coverage. Sounds great, right?

We will look a little deeper into what insurance companies are looking for when making their determination to insure diabetics. But, first, let’s take a closer look at the disease itself.

About Diabetes

About Diabetes

Diabetes is a condition that occurs when your blood sugar level is not regulated and rises much higher than it is supposed to. It can affect anyone. It is found around the globe – amongst all different ethnicities, ages, and sexes. Diabetes is the leading cause of blindness, heart failure, stroke, kidney failure, and amputations.

Here is what happens: Every time you put food in your mouth, your body takes that food, and transforms it into sugars – which are also known as glucose. Then, your pancreas releases insulin to allow your cells to use this glucose as energy. Insulin is very important. When it is not released, quite a few medical issues can result – including diabetes.

The two major – and most widely known – types of diabetes are Type 1 and Type 2.

- Type 1 is the more severe form of the condition. It can affect people of all ages but usually presents itself in childhood. These individuals are dependent on insulin because their body has begun to attack the pancreas and does not allow for the insulin production. This is also considered an autoimmune disorder.

- Type 2 diabetes is more commonly diagnosed in adulthood and does not require the dependence on insulin. Instead, the glucose levels are closely monitored, and medications are generally prescribed to help the body better make use of its insulin. Diet and exercise are also an important key to the management of Type 2 diabetes.

Why Insurance Companies Want Your Medical History

When determining your eligibility for coverage – and determining just how much you will pay for it – insurance companies will want to look into your diabetes diagnosis a bit deeper. Because, while millions of people may be diagnosed with diabetes, each person controls it differently. This depends greatly on medical treatment as well as personal care and attention.

For example, if you do not do your part in managing your diabetes by choosing the appropriate foods or staying fit, then insurance companies are likely to consider you a high risk. In turn, you will find yourself paying higher life insurance premiums, compared to a person who’s controlling their diabetes and living a healthy lifestyle. If your diabetes is poorly controlled, you can be declined altogether by the life insurance companies.

Basic Underwriting questions for Diabetics

- Your normal fasting blood sugar level.

- Any use of Diabetes related technology

- A history of your A1C levels.

- A list of the medications you are currently taking.

- The age you were when you were first diagnosed with diabetes.

- Use of an endocrinologist

- Use of Tobacco alongside having Diabetes

- Are you following Doctors orders and being compliant with treatment?

- Any complications that you have had, medically, as a result of your diagnosis.

By collecting this information, underwriters can begin to piece together just how well you take care of yourself and manage your diabetes.

Qualifying for Coverage

Just because you have been diagnosed with diabetes does not mean you will not qualify for term life insurance for diabetics. In fact, there are many people who have medical conditions – including diabetes – that are offered life insurance.

If you are looking for an affordable option, however, you are going to want to take care of your health. After all, it is not necessarily your diagnosis that will keep you from coverage, but rather the way in which you manage it. What is your lifestyle like? How seriously do you take your diabetes?

Here are a few ways in which you can healthily manage your diabetes when (or before) seeking life insurance coverage:

Make healthy food choices. It seems like a logical step for everyone but is more imperative for diabetics. Choose whole foods that have been processed minimally or not at all. These may include vegetables, fruits, whole grains, beans and legumes, and lean meats such as chicken and fish.

Eat right. Don’t just eat the right foods – eat the right amount of them, too. This is key.

Eat smaller meals at scheduled intervals. By doing so, you are assisting your body in regulating your blood sugar.

Monitor your glucose levels. Don’t just assume they are ok because you feel ok. Check them regularly. This can allow you to see what affects your levels, what doesn’t, and to catch a problem before it gets worse.

Take your medicine. If you have been prescribed medication – take it. Follow the exact dosage instructions and take your medication as its intended to be taken. Many people choose to avoid doing this or forget and it can lead to serious complications.

Include exercise in your life. It does not have to be extreme and it doesn’t have to take over your life. A simple fitness routine done regularly can do tremendous things for your health. Consider joining a team sport, going for a walk, ride a bicycle, or find new trails for hiking. (Always seek the advice from your physician before starting any fitness routine.)

Manage your stress. Stress can wreak havoc on even the healthiest of bodies. Since it cannot always be avoided, learn ways to manage stress that will allow you to remain calm and peaceful.

Visit your doctor regularly. Get checkups, have your bloodwork done, and stay on top of your health. The more regular you visit, the more likely you are to catch a complication of diabetes before it gets out of hand.

Insurance companies want to know that you are taking care of yourself. The less you do, the greater of a risk that you become. Start taking your health seriously today – not just for the life insurance premium, but for yourself and your family. The better your overall health, the lower your life insurance premiums!!!

How Independent Agents Can Help!

You can do a lot of things on your own. Finding yourself affordable life insurance is one of them. However, when you have someone such as an independent agent to help you, why would you want to?

Not only can they take the burden off of your hands, but independent agents know just where to look for the best possible insurance policies base on your needs. They have companies that they work with throughout the country and they know the ins and outs of the industry. What does that mean for you? It means they won’t waste time applying for coverage at companies they know typically do not provide policies for those with diabetes and will focus their attention on those that they know do.

Another reason to consider seeking an independent agent is due to the number of questions that need to be answered in relation to your medical conditions and lifestyle. If you were to apply for coverage on your own, you would have to complete these – often extensive – questionnaires on your own. Time and time again for each insurance company. However, by choosing to use an independent agent, you would only need to fill them out once. The agent would take care of the rest. Sounds much easier, doesn’t it?

Don’t let your diabetes keep you from providing security for your family once you are gone. Obtain the best term life insurance for diabetics coverage you can – and at a price that you can afford.

Contact us today at 888-629-3064 to get started on finding your life insurance policy! It simply takes a quick 5 minute phone call with an agent, to help us determine what options you’d have. We are apart of the diabetes community, and love assisting with your life insurance needs.