Home » Life Insurance for Hispanics With Diabetes

Life Insurance for Hispanics With Diabetes

Matt Schmidt

Chris Stocker

To learn about Diabetes Life Solutions commitment to transparency and integrity, read our Editorial Disclosure

Last Updated on February 24, 2026

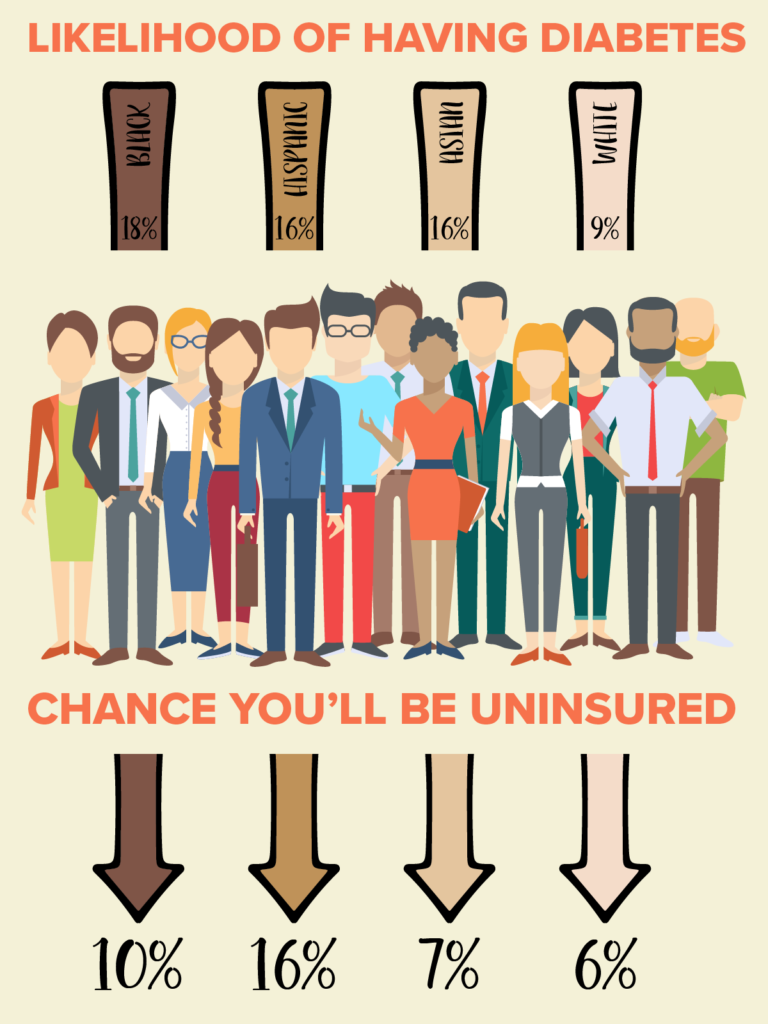

Receiving a diagnosis such as diabetes, which is a chronic disease can be very disturbing and worrying. As the number of Hispanics diagnosed with diabetes continues to rise, the fear of developing the disease is very real within the community. Per the Guardian, nearly 16% of the hispanic population with diabetes will be uninsured.

Considered as a high-risk group, Hispanics face many challenges in the management of their diabetes and in the quest to obtain life insurance as a means of protecting their families. Finding an affordable life insurance policy for Hispanics with diabetes can be difficult, but this is why you want to work with a specialist with Diabetes Life Solutions, to help with your life insurance needs.

Almost 60% of Hispanic women and 50% of the Hispanics are or will be diagnosed with diabetes.

Finding life insurance with Diabetes while being Hispanic does not have to be difficult. In all honesty, it may be easier than you imagined.

The key to finding the best life insurance policy is working with a group like Diabetes Life Solutions, who specializes in working with families of the Diabetes community. Upon learning more about your financial objectives, and Diabetes history, we can help you find the best life insurance provider for your personal situation. We understand how important life insurance coverage may be, and all the ways life insurance can protect you and your family.

The Liability Label

Already labeled as a potential claims risk, the lack of access to quality healthcare that so many people within the Hispanic community face amplifies the reservations of life insurance companies when considering Hispanic applicants as potential policyholders. The same hurdles to achieving proper healthcare services make many diabetes patients unable or poorly equipped to receive treatment and the necessary prescriptions and testing supplies – like home blood glucose monitoring meters, test strips, and lancets – that are essential to successfully manage and monitor their diabetes.

A lack of medical care and treatment often predisposes people diagnosed with diabetes to an array of new secondary illness as a result of the damage the unmanaged or poorly managed diabetes has done on the body. The hispanic population faces a higher risk of developing Retinopathy, Neuropathy, and other types of Diabetes complications.

Risk Factors and Generalization Discourage Potential Policyholders.

The Hispanic community is one of the fastest growing demographics in our country – and half of them will be diagnosed with diabetes at some time during their life. With the burden of health care costs and an alarming frequency in the incidence of diabetes diagnosis, the decision to buy a life insurance policy has been considered as an expense that the Hispanic population with diabetes, views as unreachable.

Obtaining life insurance as a Hispanic with diabetes is achievable!

Further complicating the process, a large number of Hispanics residing in the U.S. reside here illegally, rendering them ineligible for health insurance. Even children of illegal immigrants fall victim to a lack of healthcare because the Medicaid system is bogged down and approval takes an extensive amount of time. This lack of health care coverage reflects negatively on the Hispanic community when trying to obtain a life insurance policy. Fortunately, health care reform is working to alleviate the burden that so much of the hard-working Hispanic population faces when dealing with the health care system in this country.

Also, many people of the hispanic community may not have a Social Security Number. Many companies will not offer coverage to a person who does not have a Social Security Number. However, Diabetes Life Solutions has partnered with certain life insurance providers, who will consider coverage for a person who has an ITIN. Combining Diabetes, and an ITIN makes life insurance coverage difficult, but we can help!!! Just call 888-629-3064, and speak with one of our agents.

We strive to ensure that all Hispanics With Diabetes can obtain a life insurance policy!

Due to the statistical projections, even Hispanics that are currently in good health standing may find themselves struggling to secure the life insurance premium rates that they feel they are entitled to – all because they are statistically at a greater risk for developing diabetes, even if they never do. Add in additional risk factors, like obesity, family history of the disease, age, a personal history of gestational diabetes, and the odds seemingly not in favor of Hispanics hoping to receive an affordable monthly premium.

SSN – ITIN

It isn’t uncommon for a significant portion of the hard-working Hispanics in our country to be without a Social Security Number (SSN). This absence of a social security number is often due to recent immigration or lack of citizenship – leading much of the Hispanic community that could greatly benefit from holding a life insurance policy to assume they are ineligible for purchasing life insurance policies.

Fortunately, there are opportunities for Hispanics who do not have a SSN, but do have an Individual Taxpayer Identification Number (ITIN), to successfully purchase life insurance to protect their family’s well-being in the event of their passing.

If you have an ITIN, you can qualify for a life insurance policy

We understand the hardships that accompany moving to a new country and we are happy to have the pleasure of being able to do business with life insurance companies that recognize the need to assist transitioning Hispanic families in securing a strong financial future for their families. We applaud the dedication to family that is so profound within the Hispanic community, and we want to make it possible for them to attain a high-standard of living and a promising future by providing high-quality life insurance options at affordable prices. Prided on equality and servitude, we are ready to assist you throughout the process of applying, choosing, and purchasing a policy best suited for your family.

Re-visit and Reconsider – Why Life Insurance is Important

No matter what your ethnicity or health status, life insurance proves a valuable investment for most people. If you’ve not saved a substantial sum of money and made arrangements for your assets in the event of your passing, life insurance can be a reliable source of financial security for your loved ones. Life insurance also maintains many living benefits for the Hispanic community. As an ethnicity where more than 1 in 4 individuals face financial hardship, the cash value that a life insurance policy generates over time can come as a huge relief for Hispanics who may need to borrow from the policy for a source of payment for emergencies, college tuition, or the costly replacement of a vehicle.

The Hispanic Diabetes community is usually able to obtain all types of life insurance coverage. This includes term life insurance, and whole life insurance with diabetes.

Even if you have Type 1 Diabetes, Gestational Diabetes, or Type 2 Diabetes, you’ll most likely have options available to you. Life insurance doesn’t have to be hard to obtain. We know what companies will accept the Hispanics and Diabetes Community. You may even have no medical exam life insurance options available to you.

Many Hispanics Value Life Insurance, But Do Not Own a Policy

Hispanics are historically less likely to hold life insurance policies than individuals of other ethnicities, as the majority of Hispanics feel that premiums remain too high for them to comfortably afford – viewing the ownership of life insurance as a luxury not suited for families that might be financially unstable. While the Hispanic community ranks the responsibility of providing for their families as a higher priority than some other communities, they remain one of the lowest policyholders nationwide. Expressing a desire to invest in life insurance to secure the future of their families, it is important that this underrepresented group of people understand their life insurance policy purchasing options.

Hispanic communities value their families as a high priority, so a life insurance policy is something that can help keep their family financially safe after their passing.

Consider Your Value

Many people are inclined to believe that their benefits package through their employer is suitable coverage. What most people don’t consider, is the fact that the $10,000 – $25,000 guaranteed through their employment benefits package may barely be substantial enough to cover funeral expenses. When considering life insurance, it is essential to consider the total accumulation of loss that your family will experience if you should pass. The loss of an annual salary can be detrimental to a family that is living comfortably, or even worse, struggling and dependent on a dual income. Stay at home moms carry immense value too. Stay at home moms provide childcare, catering, house maintenance, and more. Consistently undervalued, the work of a stay at home mom can become brutally apparent should she pass and new expenses arise – like childcare, etc.

It is important that women who stay at home with their children also have a life insurance policy.

Life Insurance May Be More Affordable Than You Think

While a large portion of the Hispanic community declines to purchase life insurance for Hispanics with diabetes policy due to fear of unaffordability, most would be delighted to know that most life insurance companies offer affordable and highly competitive rates. For Hispanics that are in good health standing and are maintaining a healthy lifestyle, additional discounts may apply. Life insurance may be significantly more affordable than you may have originally thought it to be. The best way to educate yourself on your policy options and potential monthly premiums is to call an independent insurance agent directly and request quotes. Friendly professionals will be happy to assist you with the process of securing a life insurance Hispanics diabetes policy that is best suited for your needs.

Many policies can contain riders that offer even more than just a death benefit. Many families can benefit from living benefit riders that allow for insureds to access part of the death benefit while living. If a person is diagnosed with a terminal, chronic, or critical illness you may accelerate a portion of the death benefit while living. A policy with these types of living benefits may be of great value to you.

Even if you are in poor overall health or have recently undergone serious medical treatment. We would still have guaranteed acceptance policies available to you. These policies are designed for those who are not in ideal health. You cannot be declined, and there are no medical exams nor medical questions asked. Many families secure burial insurance policies like these to address final expenses and the costs of a funeral.

Life insurance policies are more accessible than you may think. Work with specialists like us to help secure a life insurance policy today.

Make Life Insurance a Priority

Regardless of the discouragement and adversity faced by Hispanics trying to purchase life insurance in the past, life insurance doesn’t have to be unattainable – and the process of finding the policy that is right for your family’s needs doesn’t have to be tedious and painful. Make finding the perfect life insurance Hispanics diabetes policy a priority, it may be the smartest investment you’ve ever made and the biggest relief you’ve experienced in a long time. Knowing your loved ones will be taken care of long after you’ve passed offers peace of mind that is unparalleled.

Bi-lingual agents are standing by to assist you with all of your life insurance needs. Even if you’ve been declined for life insurance with Diabetes, contact us. Most likely you’ll have life insurance options available to you. Simply call (888) 629-3064. Let the leaders in Hispanics and Diabetes life insurance help you and your family out today.

Matt Schmidt

Matt Schmidt is a nationally licensed diabetes insurance expert. Over this time frame he's helped out over 10,000 clients secure life insurance coverage with Diabetes. He's frequently authors content to Forbes, Entrepreneur, The Simple Dollar, GoBanking Rates, MSN, Insurancenews.net, and Yahoo Finance and many more.

Matt Schmidt is also the Co-Founder of Diabetes Life Solutions and Licensed Insurance agent. He’s been working with the Diabetes community for over 18 years to find consumers the best life insurance policies. Since 2011, he has been a qualified non-member of MDRT, the most prestigious life insurance trade organization in the USA

Find out how much life insurance with Diabetes Life Solutions costs