Last Updated on June 14, 2025

You finally think that you have scored the perfect job. You love what you do, you love your co-workers, and you love your company’s benefits package. It even comes with a free or discounted group life insurance policy. You find yourself jumping at this bonus because, well, it’s free or cheap. Who wouldn’t be excited, right?

Free is always good. Cheap may be good. But, when it comes to group life insurance, do you really want to put your family’s security in the hands of your employer’s group policy? You never know what life may bring and, while you may be thrilled now, you may not be later. Maybe your Diabetes is under control now, and you don’t have any other health issues. But in the future, can you be 100% certain this would remain the case? Group life insurance pros and cons are many and you should know all of them.

Group life insurance policies can be great – yet, they can also be a poor choice. This is dependent on many factors, of course. So, before you jump with excitement and begin making decisions, read this first. Having all of your life insurance through your employer is a horrible idea. You’ve heard the old saying that putting all your eggs in one basket is never ideal. So why do this with your Life Insurance??? Are you going to stay with this employer forever? Most likely not. So why would you want to tie your entire life insurance portfolio to an employer who may fire you in the future?

We’ve broken down the advantages of group life insurance policies, from what they are, how they work, the pros and cons – and whether you should even consider them.

What is Group Life Insurance? How Does it Work?

Before we get too deep, let’s look at what group life insurance is. Many employers offer life insurance as a perk in addition to health insurance coverage. These are group policies held by your employer and offered to you – the employee – at either a so-called discounted rate or no charge at all.

Because your employer has decided to offer this life insurance collectively to its employees, the insurance provider offers them a discounted rate. This rate is usually based on the makeup of the company. For example, the insurance company will take into consideration the ratio of men to women, the average age of the employees, and even the line of work they perform. Depending on the group policy a person with diabetes may be able to qualify for coverage. Plans vary from employer to employer, so there is no guarantee you’d be accepted if you have Type 1 or Type 2 Diabetes.

Generally, the greater the risk, the greater the fee. A company with primarily older employees may have a discounted rate that is higher than a company with younger employees. The insurance company assesses its level of risk and, while a discount is offered because of the mix of employees, it will still be affected by the structure of the group.

Offering employees additional life insurance (on top of the life insurance provided by the workplace) at the discounted rate is not uncommon at all. While this may sound like a win-win for all parties, it is incredibly important to consider many factors first. To start with – how much life insurance are you receiving from your employer and just how much do you need overall?

Do I Need to Submit to a Medical Exam for Coverage?

Every employer’s group policy will have different requirements. Some may request you submit a blood and urine test, for the insurance company to test. This is considered a medical exam for purposes of applying for life insurance. They’ll look for traces of nicotine, traces of illegal drug use, measure your A1C and will test other vitals.

The results may determine if you are eligible or not. Along with the lab results, they may also ask other health history questions. Your complete risk profile would be weighed, and a decision is generally made in a matter of days, or weeks.

Other types of group policies are considered non-medical exams plans and will not require these extra requirements. The life insurance company would most likely ask basic health questions, and then make a decision in a matter of minutes.

How Much Life Insurance Do You Need?

This amount is going to vary depending on individual circumstances. For example, someone who is the sole provider for a family of four will require a higher amount of life insurance than someone who is single with no dependents and very little financial obligations.

But, the question is how do you determine the final amount? Here are some group life insurance pros and cons and things you will want to consider:

How much will you need to meet your immediate expenses after death? You will want to determine funeral expenses, mortgage balances, outstanding debt, estate-settling costs, etc.

Consider what will be needed to sustain your home as it is currently. Your family will be struggling to move forward in life without you, by providing a secure level of life insurance, they will be able to focus on their grief and find a new normal without dealing with financial struggles. What amount do you contribute each month to sustain your family?

Don’t forget about future expenses. For example, college tuition for your children. If you would have paid it or contributed to it if you were alive, then you will want to make sure to include it in your life insurance.

Taking all these things into consideration can help you calculate the amount of life insurance you will need. For most people, the amount offered by an employer does not meet this amount. So, be careful with your calculations so that you can ensure that the loved ones you leave behind are cared for.

Why You May Want It

First, free is free. If your employer wants to provide you with diabetes life insurance as part of your bonus package or perks, why wouldn’t you take it? Even if you don’t think you need it, it is always good to have. And, if you want more, you can likely get it at the cheaper, group rate through your employer’s insurance company.

Second, if you are overweight, have any medical conditions or even some severe pre-existing conditions, you may have a tough time finding an affordable life insurance policy on your own and look for group life insurance pros and cons. Because group life insurance policies take everyone into consideration, you may actually have a better chance at obtaining affordable life insurance through your work.

Third, employers usually dish out group life insurance to employees based on their current salary. Some may provide coverage that is comparable to your current salary, others may round up or down, or even double your salary. Other employers may choose to do a straight $100,000.00 policy across the board. It all depends. But, group life insurance usually comes with the option to add additional coverage to supplement what your employer is paying. And, this likely comes at a discounted group rate.

It is important to note that there is nothing wrong with accepting the free life insurance coverage from your employer – you deserve it. However, it is important to keep in mind that this life insurance policy is not meant to be your one and only.

Lastly, there is a convenience factor associated with group life insurance. Maybe it has been on your “to do” list for quite some time. Maybe you have wanted to obtain life insurance but didn’t know where to start. Or, maybe it is just something you haven’t really thought about. When it is offered by your employer, you usually just need to sign a few simple forms and state your beneficiary – then you are covered. After all, when Human Resources hands you the forms and you just sign and hand them back – you really cannot get any more convenient than life insurance through work.

There are a plethora of advantages of group life insurance. Take it as the gift that it is, but make sure you do your research and determine the level of coverage you need to keep your loved ones taken care of should you die.

Why You Don’t

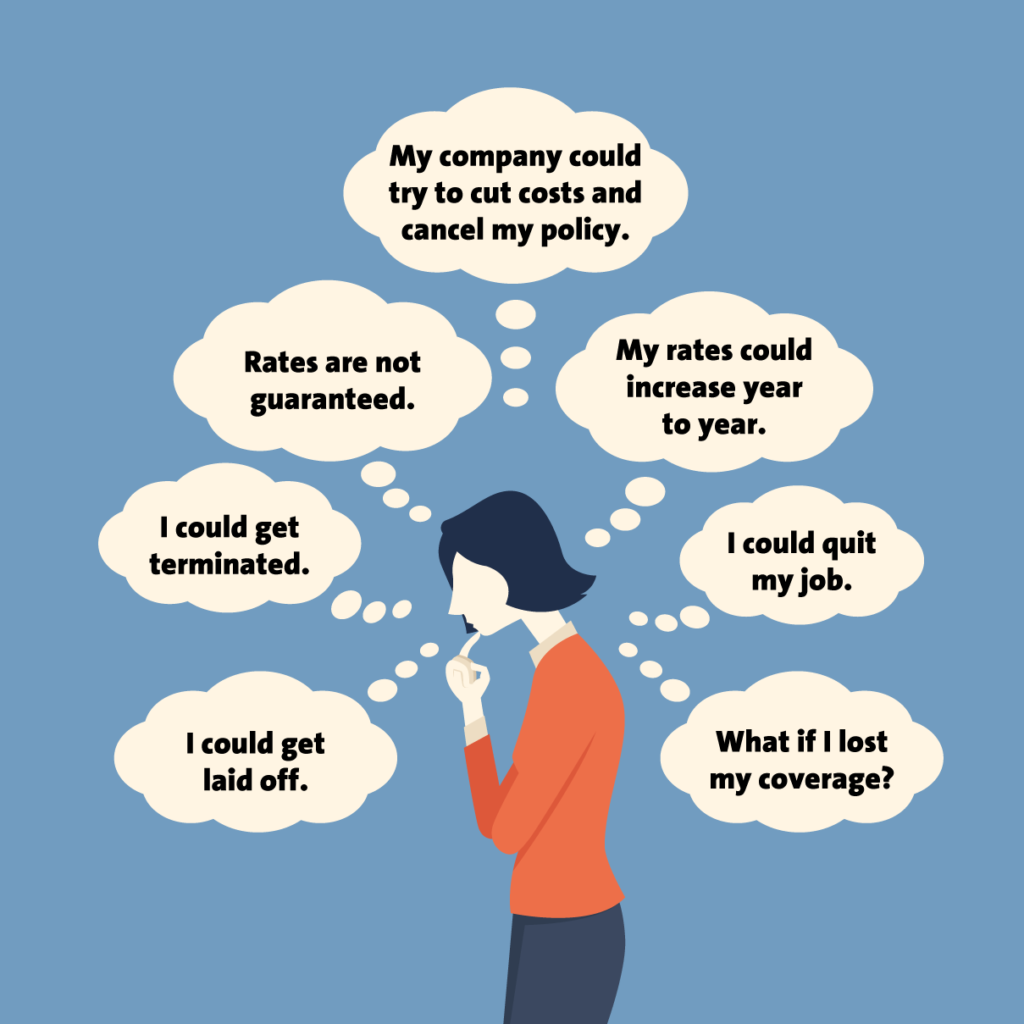

While there are a few reasons why you would consider choosing to accept your group life insurance coverage, there are also reasons for why you wouldn’t.

Many group life insurance rates are for term life insurance.

This means that your policy will be good for a specific amount of time and then it could run out. Granted, your employer may then have another policy in place – but can you count on that? If you are looking for whole life insurance – a policy that will cover you no matter when you die – then you may need to seek a policy of your own. Be sure to read all the policy information about your life insurance so that you truly understand what it is you are getting.

Group life policies may also immediately decline you if you have a type of diabetes complications. Many common diabetes complications such as neuropathy or diabetes retinopathy will be lead you to not qualifying or a group policy.

Lastly, most group policies do not offer all the types of riders, that most life insurance policies carry on an individual basis. Certain life insurance riders, such as living benefit riders, may be of great value to you and your family. You will always have better life insurance options outside of your group employers’ coverage. Or if you are in poor overall health, you may only qualify for ‘guaranteed issue policies’ that guarantee your acceptance.

Group life insurance policies are calculated based on the employees as a whole.

For someone who has a lot of health concerns, participating in a group policy may be the most affordable way to obtain insurance. However, if you are young and healthy, you may find that the group life insurance costs you more than what you could obtain on your own outside of the office. This is especially true if you work with an older population. Keep in mind that this may not be relevant should you accept the free life insurance policy from your employer, but it will surely matter if you decide to purchase supplemental insurance using the group rate. Do your research – and obtain quotes – before purchasing insurance this way. It is better to get life insurance through work than at your own.

Lastly, your life insurance policy can be canceled at any time. Life happens.

Your employer could change life insurance carriers, and the new one may not underwrite your health risks any longer. Perhaps you have developed a form of diabetes complications such as diabetic neuropathy. Now you are no longer eligible for the group policy.

Years from now you may decide to make a great move for your career, but find out your new employer doesn’t offer life insurance. Then what? Due to your age, you may find it hard to obtain affordable life insurance on your own. You never want to leave yourself in this vulnerable state. Do not put your safety net or that of your family, solely in the hands of your employer. You never know the curve balls life may throw at you, but you can be prepared with your own life insurance policy so that you are ready whenever it does.

Consider it Supplemental

Perhaps the best thing that you can do is accept your employer’s advantages of group life insurance policy – but only as a supplement to your own. That is, only if it makes sense. If you have to pay for the policy, make sure to do your research first. Contact an independent agent to obtain some quotes on your own to determine if your workplace’s discounted life insurance is a good deal or not. If it’s free or incredibly affordable then, of course, it makes sense to accept it. Besides, who wouldn’t want the extra perk of a year or two’s salary to help take care of things when you are gone? If this is a bonus or perk with your job, then take it.

But don’t stop there.

Consider the life insurance that you receive through work as a bonus. Don’t let it be the final resting place for all your unfinished needs and business when you pass away. Believe it or not, your spouse and children, if you have them, will not get far without you on a year’s salary once funeral expenses, outstanding debts, and other obligations are taken care of. You will need a larger policy.

According to most financial professionals, and financial experts at Nerdwallet.com you should NEVER have all your life insurance coverage tied to an employer. Even Dave Ramsey frowns upon this.

Calculate what you need and seek an independent agent for assistance in obtaining it. Considering it as a supplement to your work life insurance means that you are not putting all your eggs in one basket, nor are you leaving your loved ones’ future to chance.

What You Really Should Do

When it is all said and done, group life insurance is a wonderful supplement to your own life insurance policy. There are far things more satisfying than knowing you have a healthy life insurance policy that you know will take care of your loved ones should something happen to you. Leaving this all in the hands of a group life insurance through work is not the best way to go about it.

So, what you really should do is contact an independent agent and get this set up – before it is too late. An independent agent can make the entire process simpler. They have a knowledge base for life insurance that likely extends further than yours. Combine that with their extensive network – and you are likely to receive the best quotes from the most reputable sources.

Not to mention that filling out paperwork over and over to obtain multiple life insurance quotes can be tedious and unwelcome. When you choose to work with an agent, you only have to handle the paperwork one time. Score! Plus, when working with your independent agent will get your quotes and can then review everything with you – answering any questions you have and help you make an informed decision.

Not to mention that filling out paperwork over and over to obtain multiple life insurance quotes can be tedious and unwelcome. When you choose to work with an agent, you only have to handle the paperwork one time. Score! Plus, when working with your independent agent will get your quotes and can then review everything with you – answering any questions you have and help you make an informed decision.

Life insurance should be a part of each and every person’s financial planning. This is especially true for those who have dependents, spouses, or are the main provider of the home. After all, you insure your car and your home – why wouldn’t you insure your life?

If you find yourself in a position to be a part of a group life insurance through work policy, don’t rule it out. Any little bit helps – especially if it is a free policy. Accept the nice perk – then go get your own!

Here at Diabetes Life Solutions, we like to help our clients weigh these pros and cons. It can be nerve wracking while navigating the life insurance market place while having Diabetes.

To get some information on a policy that you TRULY own, and is not tied to your employer, feel free to contact us. We love working with the diabetes community! A quick 5-minute phone call to 888-629-3064 would be all it takes to receive some information.