Home » Declined Life Insurance for Diabetics? Here’s What to do Next

Declined Life Insurance for Diabetics? Here’s What to do Next

Matt Schmidt

Chris Stocker

To learn about Diabetes Life Solutions commitment to transparency and integrity, read our Editorial Disclosure

Last Updated on December 13, 2025

Here’s What You Need to Do

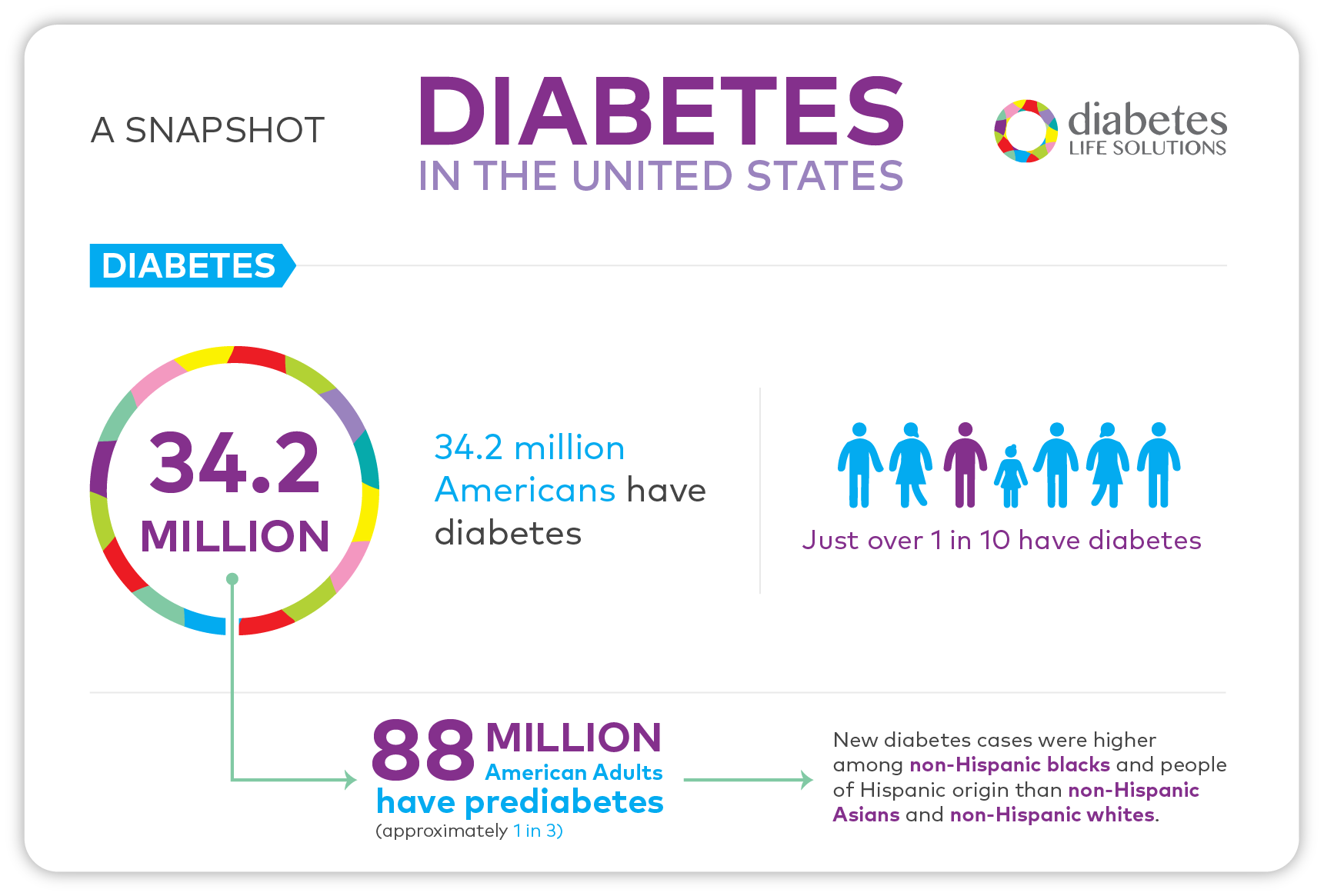

Looking for life insurance with diabetes is never an easy thing. As you know, nothing with diabetes is simple. If you are like the majority of the diabetes community, you’ve applied for life insurance and have been declined due to your diabetes history. Maybe you’ve even been declined life insurance due to diabetes. All of this is very common for applicants seeking life insurance with diabetes.

Sadly, every day somebody has been denied life insurance due to diabetics, all because they worked with the wrong agent or life insurance company.

In the event you fall into this category, take a deep breath. Most likely you have simply been applying to the wrong insurance companies, or maybe working with the wrong agent. Contact us at 888-629-3024, and speak with us. We’d love to see if it’s possible for you to obtain life insurance coverage. Afterall, Diabetes Life Solutions was founded to help those with diabetes obtain affordable coverage.

Even in this Covid 19 environment, people with Diabetes still have life insurance options. Most life insurance companies have reverted back to their original underwriting guidelines from the pre-covid world. Don’t give up hope if you’ve been declined life insurance due to diabetes. Simply work with us and let us guide you in the right direction.

If you have been diagnosed with diabetes and have been unsuccessful at obtaining life insurance – don’t give up. Of course, life insurance is one of the most important things you can do for your loved ones and, upon your death, it will provide your family with everything they need to take care of themselves, handle your financial obligations and debt, and take care of your funeral expenses. Without it, you may leave them grieving and in a financial nightmare. Knowing this can really cause you a great amount of undue stress, too.

So, just because you were declined life insurance due to diabetes, possible due to your Diabetes history, doesn’t mean you still can’t obtain it. There are many companies to choose from — so you definitely have options. Finding the right policy, though, can be time-consuming and complicated. Working with an independent agent who specializes in working with the Diabetes community can help you discover why you were declined and determine a better strategy for obtaining you the coverage you deserve – at a rate you can afford.

Quick Article Guide

Here’s what we’ll cover in this post:

Why were you declined?

After you went through the tedious application process for life insurance, you were probably very disappointed to hear that you were declined for coverage. Don’t let that correspondence be the end of the road. It is crucial for you to find out why you were denied life insurance due to diabetes before you can go any further. Unfortunately, some insurance agents don’t know where to place Type 1 and Type 2 individuals with Diabetes, and maybe you were automatically declined life insurance due to diabetics and underwriting guidelines. We know how frustrating this can be. Don’t get discouraged because another agent failed you. Rather contact us or complete a quote request. We’d love to help out!

You can reach out to the company directly or turn matters over to your independent agent. The more details you can obtain about your denied life insurance due to diabetics, the better. This will help you build a strategy as you proceed to move forward with applying for life insurance coverage again. We’d also recommend that you obtain a copy of your lab results, if you had completed a blood test with your previous application.

Otherwise, if you continue to apply in the same manner, you will likely get the same results. That is a waste of time and effort. It also affects your file with the Medical Information Bureau.

The Medical Information Bureau

You have likely never heard of the Medical Information Bureau, as many have not. Also known as MIB, the Medical Information Bureau is a company owned by over 400 insurance companies. So, if you have applied for individually underwritten coverage anytime in the past, they may have a file on you.

The MIB stores the information – in the form of codes (not your actual health records) – so that underwriters can use it as part of the process. And while you may not even have realized it, if they have a file for you, then you have likely given them permission to accumulate your information somewhere along the line.

When you apply for insurance, the company will access your information with the MIB and use it – along with your medical exam and completed application – to make a determination regarding the sale of a life insurance policy to you. Underwriting departments will use the information in the MIB to support your answers to the health questions on your insurance application.

Think of it like a credit report – if you want to finance a purchase, the bank will review your credit history. If you have a lot of collections or delinquent payments, you may seem too risky and be denied the loan. In the same way, if your health looks too risky for the life insurance policy you have applied for, your application may be declined life insurance due to diabetics.

None of the information with the MIB is a big deal until they get your life insurance denied because of diabetes. Then, guess what? That life insurance declined because of diabetes coverage gets noted in your file with the Medical Information Bureau and can be viewed by the next company you apply with. This isn’t as big a deal if you’re applying to companies who require medical exams. But if applying for non medical exam life insurance policies with Diabetes, your MIB report is crucial and can affect the type of offers made.

This is the exact reason why you need to seek guidance from an insurance professional. An agent that knows how the business works from the inside and how to best get you coverage. Together you can determine how to approach another insurance company for coverage and will understand what to say when you are asked – why were you declined?

It’s as simple as choosing the right company

Just like you would never wander through a toy store looking to buy a new sofa set for your living room, you may not score the best option for life insurance from one company but may pass with flying colors at another. Each company is unique, and each has its own set of special criteria they use when determining coverage for those with diabetes or other health issues.

For instance, company A may have tough underwriting criteria and, despite that you are incredibly healthy with well-controlled type 2 diabetes, you will get denied life insurance due to diabetes instantly. However, company B may be favorable to those with type 2 diabetes under average control. And, still, company C may offer affordable life insurance with type 1 diabetes, type 2 diabetes, or pre-diabetes. We’ll also point out that the medications being prescribed also have a role in determining which companies and products you may be eligible for. Being prescribed insulin as an example, is a knock out question for some life insurance plans.

Various companies will have different products to offer. Some may offer term life insurance plans, while others only offer permanent insurance options including Whole Life Insurance. Your financial goals and objectives will help agents determine what companies may be the right fit for you and your family.

Each company has specific underwriting criteria that will help you know whether you will qualify or be turned down. It would be a tolling job to read through the criteria for each insurance company before you apply. But, in order to find the one that will accept you based on all your medical history, exam, and application, you will need to do so. Or, seeking the help of an independent agent can be extremely beneficial. Agents know the companies and know what they will and will not accept. This will not only help you succeed at obtaining coverage but also in keeping your MIB file from reflecting so many declines in coverage.

What we like to do here at Diabetes Life Solutions is to find out more about your financial goals, and overall Diabetes history. Once we know more about your personal situation, we can help make suitable recommendations.

Keep your blood sugar stable

If you have been diagnosed with diabetes, then you should be fully aware of just how important your blood sugar level is. And you should also know that you should be monitoring it and adjusting it as needed all the time.

Your A1c can be the determining factor for some insurance companies. This test reflects the average blood sugar level over the last two to three months. If you are diligent in your diabetes management, then the A1c results will reflect that. However, if you slack and do not take the care that you should, the test results will reflect that, too.

All life insurance companies will view your A1C and Glucose readings differently. One company could have your coverage for life insurance declined because of diabetes, while another may offer you a policy with an A1C above 9.0. We don’t expect you to know every company’s underwriting guidelines, but rather lean on us and our expertise. If you were declined due to elevated A1C readings, you may need to wait a few months before reapplying. In certain situations, it would make sense to meet with your Doctor, and figure out what could be done to improve your levels. Once your A1C is within an acceptable range, you would simply re-start the application process.

High blood sugar can cause many serious complications in the long-term. So, if you are not maintaining yours as you should be, many insurance companies may decline your application for coverage because you are too big of a risk.

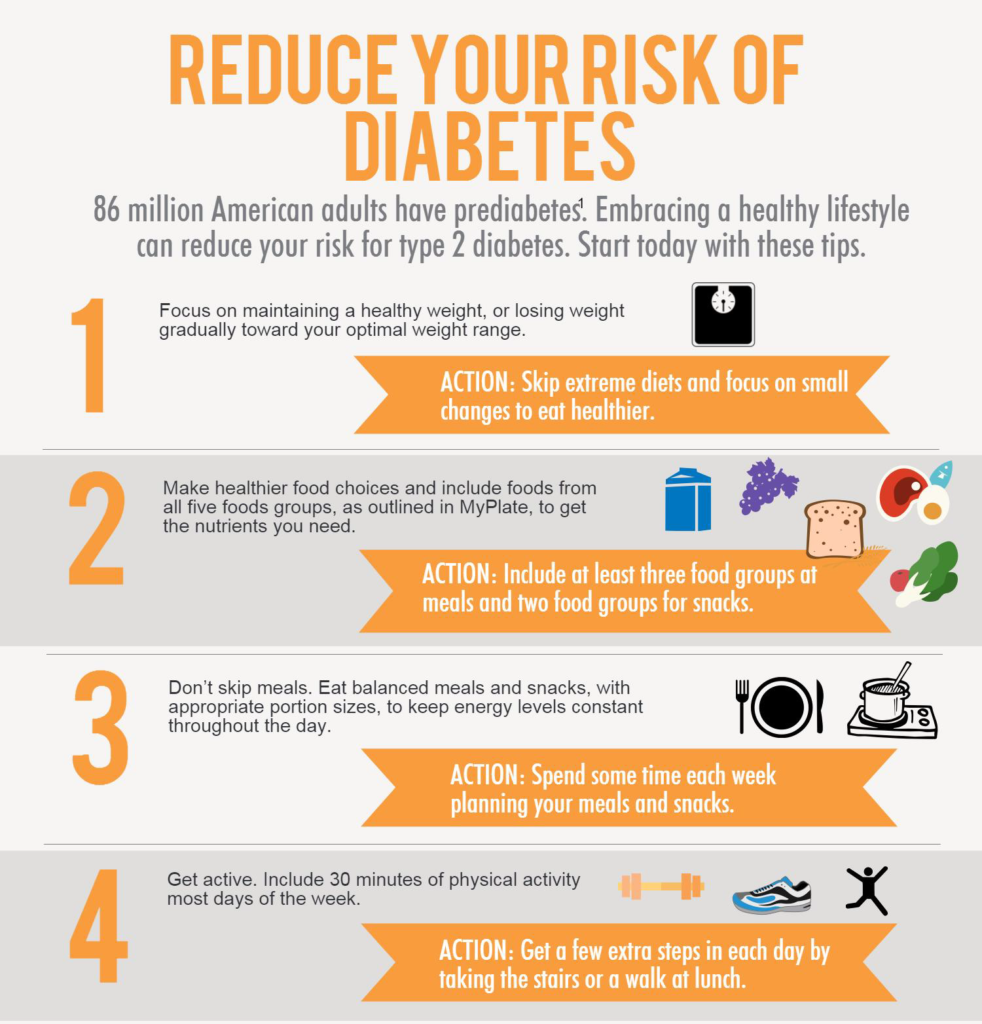

If you can, try your best to maintain a healthy blood sugar level for a couple of months before applying for coverage. Here are a few ways to help you keep your blood sugar stable:

- Move more! Increase your activity daily, trying to get at least 30 minutes of physical exercise.

- Follow your doctor’s orders exactly. Take your diabetes medications when you are supposed to and don’t become relaxed in your regiment. Being compliant with your Doctor’s recommended treatment is a must! Listen to your medical professionals!!!

- Don’t skip meals or eat at varying times. Keep your meals on a relatively set schedule.

- Don’t overdo it on carbs, sugary sodas, and fruits or fruit juices.

- Check your blood sugar levels as often as your doctor advises you to.

- Seek the expert advice of a diabetes dietitian, and please seek out an Endocrinologist.

While you are getting your A1c to an optimal level to qualify for insurance coverage, do some research or speak to your insurance agent to see what level of A1c is required by each company. That way you can determine which will be the best to apply.

Deeper medical issues

There are many long-term conditions that can result from having diabetes and many of these are worse than simply a diagnosis of diabetes. The effects can result in damage to:

- The blood vessels. These can be damaged by having too high of blood glucose levels. Because the blood vessels carry the blood to each of the organs, it can then damage the organs.

- The heart. Cardiovascular health becomes affected and can lead to things such as a stroke or heart attack. In fact, heart disease is a major cause of death for those with diabetes.

- The kidneys. Kidney disease occurs from too much protein in the urine or as a result of high blood pressure. Symptoms include swelling of the face, hands, and feet, edema, and itching.

- The nerves. Your nerves may be affected when you notice signs of numbness and tingles or loss of feeling in the lower legs, and even constipation or diarrhea.

- The eyes. These can be affected and cause suffering from cataracts, glaucoma, blurred vision, spots in vision, eye discomfort, or watery eyes.

Specifically, these conditions are heart disease, stroke, retinopathy, and neuropathy and can lead to kidney failure, amputation, and blindness.

Unfortunately, when your health reaches this stage of medical issues, it may get your life insurance for diabetics declined, also it may be more difficult to find an insurance company willing to sell you a policy. You may have to turn to policies such as guaranteed life insurance policies. These are different from traditional life insurance policies based on what they cover and for how much. The premiums tend to be higher, too. But, if you are dealing with some serious health conditions resulting from long-term diabetes, these may be your only option.

How you can help yourself

There are ways that you can increase your chances of receiving good, quality life insurance at an affordable rate with Diabetes. After all, you are more than your diabetes diagnosis. Insurance companies will look at other factors such as how healthy your lifestyle, how well your diabetes is controlled, and how healthy of a lifestyle you lead.

Some of the things that are in your control are:

Choose to follow a healthy diet. Increase the number of whole foods you eat and let go of the extra carbs, sweets, and junk food. Not only are they damaging to your diabetes, but they are also damaging to your overall health. If you can prove you are watching your diet, this will help an insurance company in offering the most competitive rates. Underwriters love seeing people who watch their diet, and have made lifestyle changes since being diagnosed with Diabetes.

Start an exercise program. This will get your blood flowing and your heart pumping. An exercise routine also reduces stress and helps you shed excess weight. By participating in regular exercise, you can enjoy all the benefits of a body that is working at its optimum level. Certain life insurance carriers offer healthy lifestyle discounts, for exercising regularly, which in turns lowers your premiums.

Discontinue your use of tobacco products. By now you should know that tobacco products are highly frowned upon – especially by insurance companies. In fact, as a smoking diabetic, you would be considered a very high risk to insure. If you want to increase your chances of obtaining a good and affordable policy, then ditch the tobacco. Insurance companies generally access anywhere from 20% to 30% premium increases for smoking. If you use chewing tobacco, then great news! Certain companies won’t rate you higher for the use of this form of tobacco.

Being healthy overall, despite your diabetes diagnosis, can make you feel better and reduce your chances of succumbing to more serious health complications. It can also increase your chances of obtaining a great quote. The better your overall control of Diabetes and overall health will make you a more favorable candidate, in the eyes of insurance carriers. A1C isn’t the only determining factor with all insurance companies, so again this is why we stress working with an experienced agent trained with working in the Diabetes community.

Use the experience of an independent agent

Just like you go to a doctor when you are ill, a mechanic when your car is acting up, or a music teacher when you want to learn piano, you should also seek an insurance agent when you need to purchase insurance. However, it is best to seek an independent agent who is well-versed in all things diabetes.

By choosing an independent agent with special knowledge and understanding of the role diabetes plays on health insurance quotes, you will place yourself in an advantageous position to obtain the best possible quote for your health condition. An experienced agent will have relationships with multiple insurance carriers, and should be able to help you obtain multiple offers from various companies.

Not sure an independent agent is right for you? Think again. Here is why you need one:

- Independent agents have connections throughout the nation that allow them to know the criteria many companies will approve for policies and those who will deny coverage. They work with the multiple underwriters from multiple companies. Knowing underwriting guidelines can help determine what companies, if any, may offer coverage.

- Independent agents work for you, providing quotes for many different insurance companies – allowing you to see the best quotes and best policy available to you. They do not have to only recommend ONE company that they are employed by.

- Filling out the application forms and answering all the questions necessary for an insurance application can be tedious and tiring. With an independent agent, all you have to do is complete this information once and they will take care of the rest – including the communication with the insurance companies.

- Choosing to work with an independent agent means that you can save time, possibly money, and frustration while also gaining the best life insurance policy at the most affordable rate. Also, they can provide unbiased recommendations from multiple insurance companies.

Final Thoughts

If you have found that you have been declined life insurance for diabetes or any other underlying medical condition, don’t give up. By applying for life insurance from the right company with the correct criteria, you will find that it is possible to obtain a policy. The key is to find the perfect company for you – and you can do so with the help of an independent agent. Don’t give up as there’s a great chance you can qualify for some type of life insurance, no matter of your Diabetes diagnosis and history.

Our website was created with only one reason in mind. To help out the Diabetes community with their life insurance for diabetics declined issues. Don’t let other websites ‘trick’ you with false information. You’ll only receive accurate information, and realistic quotes when you work with our team.

We know life insurance is an important financial product, for you and your family. You may even need life insurance for a divorce settlement, or to secure a SBA loan. Don’t let a previous decline deter you from continuing your search for life insurance.

For certain individuals, there may not be any life insurance options available at the current moment. If you fall into this category, we’ll be honest with you, and would recommend re-exploring your life insurance options again in the future.

In the event you cannot obtain the amount of life insurance you feel you need, it may be worth exploring burial insurance policies or guaranteed acceptance types of policies. While these plans have lower limits of coverage, having a policy in place for the short term may be advantageous to you and your family. We assure that we’ll uncover all the possible life insurance possible for your personal situation.

At Diabetes Life Solutions, we love working with the Diabetes community. We’ve been where you are, and understand that it can be frustrating finding affordable life insurance coverage even if you have been declined life insurance for diabetes. To get some information it’s as simple as calling us at 888-629-3024. Or start a chat with us, and we can provide you with some instant quotes.We are always happy to provide you with free, no obligation quotes and information.A

Matt Schmidt

Matt Schmidt is a nationally licensed diabetes insurance expert. Over this time frame he's helped out over 10,000 clients secure life insurance coverage with Diabetes. He's frequently authors content to Forbes, Entrepreneur, The Simple Dollar, GoBanking Rates, MSN, Insurancenews.net, and Yahoo Finance and many more.

Matt Schmidt is also the Co-Founder of Diabetes Life Solutions and Licensed Insurance agent. He’s been working with the Diabetes community for over 18 years to find consumers the best life insurance policies. Since 2011, he has been a qualified non-member of MDRT, the most prestigious life insurance trade organization in the USA

Find out how much life insurance with Diabetes Life Solutions costs