An entrepreneur at heart, Chris has been building and writing in consumer life insurance and health for over 11 years. He's contributed to 1,000+ medical, health, financial and wellness articles and product reviews written in the last 11 years.In addition to Pharmacists.org, Chris and his Acme Health LLC Brand Team own and operate Diabetic.org, PregnancyResource.org, Multivitamin.org, and the USA Rx Pharmacy Discount Card powered by Pharmacists.org.Chris has a CFA (Chartered Financial Analyst) designation and is a proud member of the American Medical Writer’s Association (AMWA), the International Society for Medical Publication Professionals (ISMPP), the National Association of Science Writers (NASW), the Council of Science Editors, the Author’s Guild, and the Editorial Freelance Association (EFA).

Home » Obtaining Life Insurance for Diabetics: Specifically on SGLT2 Inhibitors

Obtaining Life Insurance for Diabetics: Specifically on SGLT2 Inhibitors

Matt Schmidt

Chris Riley

To learn about Diabetes Life Solutions commitment to transparency and integrity, read our Editorial Disclosure

Last Updated on June 14, 2025

Life insurance is hands down one of the most important decisions you will make in your lifetime. It will single handedly help to provide for your family’s financial future in the scenario that you’re no longer there to help support them. Everyone in the Diabetes community should have the opportunity to qualify for life insurance coverage in our opinion. And it is getting easier over time to be eligible for life insurance plans.

Even worse, websites all across the internet intentionally show Diabetes consumers fake rates. This is so frustrating as you would be tricked into applying for a policy, only to have final premiums be 100% or even higher than the initial fake rates shown. Sadly, there isn’t much anyone can do about these disgusting business practices, outside of spreading the word to warn others.

Also, there seems to be several options for types of life insurance policies, available to the Diabetes community. Most people with Diabetes don’t understand that you quite possibly have the same options to choose from, as a person without Diabetes. Which policy is best for you? Term Life Insurance, or Whole LIfe Insurance? Do I need both?

On top of life insurance being a challenge to obtain the right kind that suits your lifestyle, having a preexisting health condition such as Diabetes makes things even more difficult. By being more difficult we mean rates will probably be more expensive, and certain companies may not offer life insurance to you due to living with Diabetes.

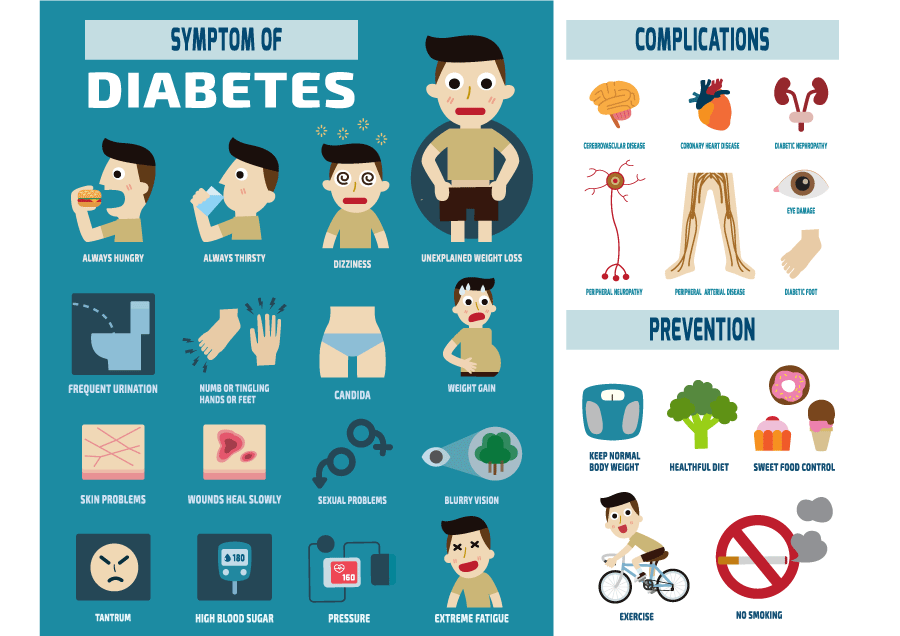

What makes matters more difficult is that if you are unable to control your type of diabetes with proper diet or exercise it can lead to other serious matters like kidney failure, stroke or heart attack. This would then put you at a higher risk tier for life insurance, or possibly cause you to only be approved for ‘guaranteed acceptance’ policies. IN some cases, a person with poor diabetes control could be declined for coverage altogether. Oftentimes using a prescription medication such as SGLT2 inhibitors can help!

Quick Article Guide

Here’s what we’ll cover in this post:

How Inhibitors Affect Life Insurance Coverage

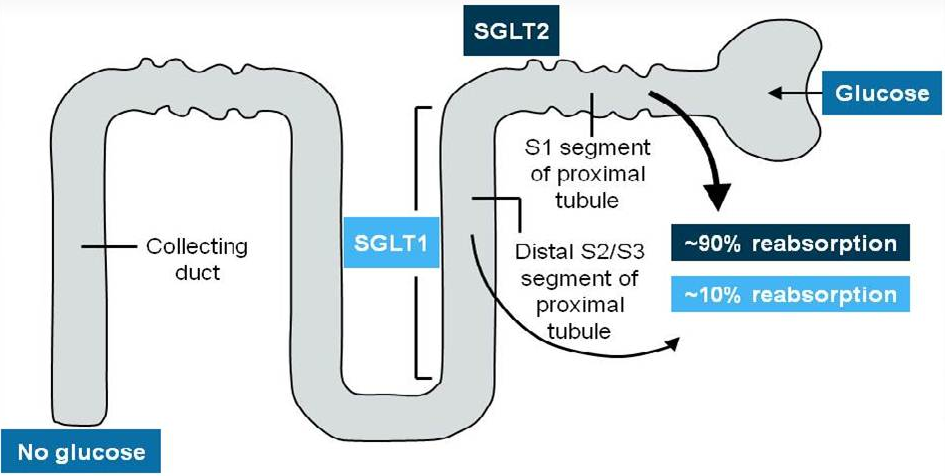

Some people haven’t heard of SGLT2 inhibitors. They are a relatively new type of medicine that is used to help individuals with Type 2 Diabetes. Also known as sodium-glucose co-transporter 2, these inhibitors when used with the proper diet and exercise can help significantly improve the individual’s glycemic control. SGLT2 is a protein in humans that facilitates glucose reabsorption in the kidney. SGLT2 inhibitors block the reabsorption of glucose in the kidney; increase glucose excretion, and lower blood glucose levels.

This new type of drug offers even better glucose control by allowing increased insulin sensitivity and uptake of glucose in the muscle cells, decreased gluconeogenesis and improved first phase insulin release from the beta cells.

When applying for life insurance for diabetics, it is extremely important to let your insurance underwriters know what type of inhibitors you use. This will allow them to better assess your health and lifestyle to adequately provide you the correct type of coverage and premium price. On the application, you’ll be asked to disclose medications being prescribed, for your Diabetes conditions.

Certain companies will provide a better offer, when taking these types of medications. And in turn, can save your family hundreds to thousands of dollars over the lifetime of the policy. One life insurance company may not rate you higher for taking these oral medications, while another could charge you 25% to 40% higher. Or some companies may require you to do an examination to be eligible, while others could simply do background reviews and approve you within 24 hours.

We don’t expect you to know what companies are best for your given health profile. That’s where WE come into play. We’ll run your profile past several companies, obtain various offers, adn let you ultimately choose what life insurance carrier is best for you. A quick phone call or online inquiry is all that it takes to begin receiving information. Our agents ONLY work with people with Diabetes, so we know the underwriting guidelines to various companies, like the back of our hands!

Types of Health Questions That Will Need Answers

When applying for life insurance with diabetes you will have to provide details to your diabetes history. Due to your condition you will have to answer some extra personal and health history questions to better inform the company of your diabetes history and current control.

Here are the types of Diabetes questions, companies will ask about:

- Age of Diabetes diagnosis

- Current A1C reading

- Medications taking for your Diabetes

- Any Diabetes related complications?

- How often do you see your Doctor for Diabetes checkups?

- Do you test your blood sugar daily?

- Do you exercise and watch your Diet?

You’ll have a choice to do a NON Medical Exam policy, or go with a company that requires a Blood/Urine test. Also, depending on what type of policy, and company you choose, they may require a review of your most recent medical records. But before you make this type of decision, we encourage you to speak with our agents and discuss which plan is best for you!!!

Now you may be wondering why a life insurance company wants to review your medical records, and complete medical history. It’s because the companies actually want to offer you the best rates possible. By allowing them to see what risk type of candidate you are for life insurance, you will generally be rewarded with a lower premium. The more information you provide, the better an offer a company may make.

In some cases, if you aren’t seeing a doctor regularly, or your Diabetes isn’t under the best control, you’ll want to avoid companies who require blood/urine tests and review of medical records. You would want to explore non medical exam options. Again it’s extremely imperative to speak with an agent, and let them guide you to the best life insurance option based upon your health profile.

As with most things and life, the higher risk you are to a company the more of a premium you will have to pay. We have seen companies even pull DMV records to see if you have had any recent accidents or moving violations.

The key is to find the best diabetes life insurance company out there that works with your lifestyle while maintaining low premiums regardless of your diabetes. Every life insurance provider is different. Letting us ‘shop’ your case to 70 plus life insurance carriers will put you in the best position to save money on insurance premiums.

How Much Will Life Insurance Cost?

Some people with Diabetes will NOT pay higher premiums. But this is determined on a case by case basis. Generally speaking, if taking a SGLT2 inhibitor and no form of insulin you’ll be viewed more favorably. We’ll even point out that some companies may not offer you insurance if you were diagnosed before age 50 and taking a form of insulin. Obviously, if you are an insulin user, we’ll want to be smart about applying, and making sure to avoid companies that will rate you higher or decline you for life insurance.

Term life insurance is the least expensive form of insurance available to people. Usually a term policy can be purchased with the following term lengths:

- 10 Year Level Term

- 15 Year Level Term

- 20 Year Level Term

- 25 Year Level Term

- 30 Year Level Term

- 35 Year Level Term

- 40 Year Level Term

The longer the duration of a policy you choose, the more expensive your premiums will be. Same goes for the amount of life insurance coverage. To determine what possible rates you’ll qualify for, it’s best to contact us, and discuss with us your goals and financial objectives.

Permanent life insurance is another option available to most people with Diabetes. With a permanent form of coverage, your policy would be designed to cover your entire life, with guaranteed premiums. Certain types of permanent life insurance may also have the ability to accumulate cash value over time as well. This ‘cash value’ could be used or accessed at some point in the future.

Not to mention, Permanent life insurance is more expensive, compared to term life insurance for Diabetics. While this isn’t necessarily a negative thing, for younger people starting a family, term life insurance may be a better type of policy initially. It’s best to contact us, discuss your situation, and financial objectives, and let us provide some accurate quotes.

It may be a wise decision to consider obtaining a term life insurance policy, and maybe a whole life policy at the same time. Assuming you would outlive the term plan, you’d have a form of permanent life insurance already in place. Locking in premiums while you’re younger is a smart decision if you have the financial means to do so.

Here are some sample rates for a Male, Non Tobacco user, Average Height/Weight, and average control of Diabetes.

Sample Rates for Male (non-tobacco users)

However, if you fall in the category of not being able to pass with flying colors and your application is denied… DO NOT WORRY. We can still work with you to get a policy that doesn’t require a medical exam so you are still able to qualify for insurance. Guarantee acceptance policies are an option for diabetics. Although due to being a higher risk, you will be paying more for the policy. These Guaranteed Issue policies are a last resort, and should only be explored if you do not have any other life insurance options.

Improving Your Health Can Lower Your Rates

Some people don’t realize it is as simple as that. It’s just like having a test you know you have to pass. You don’t just show, you study and practice so when it’s time for the test you ace it! As a diabetic, before you apply for life insurance make sure you are going to pass the medical exam. Or if we feel that applying on a medical exam basis is NOT in your best interest, we’ll recommend a no exam life insurance policy.

With the combination of eating better and exercise you will be able to increase your chances of passing the paramedical examination and getting a lower rate. Cutting tobacco from your list of bad habits will also increase your chances of getting a lower premium and better coverage. A few small life tweaks will help you in the long run.

Losing a few pounds before applying may be a good idea. Not to mention if we can show Underwriters that you have made some positive changes to your lifestyle, they tend to offer better rates. We know all the tricks to make your health profile stand out to insurance underwriters, and help you find the best policy possible.

Reasons like this are why it’s important to speak with an agent, and share with them your health profile ahead of time. WE can then determine if you should hold off on applying for life insurance, or going ahead and beginning the application process. Since everybody’s profile is different, we cannot give out ‘blanket’ advice. Rather we make recommendations on a case by case basis here at Diabetes Life Solutionshttps://diabeteslifesolutions.com/about/.

How We Can Help You!

So, how does diabetes affect your life insurance? Let’s just say that just because you find yourself with a diabetes diagnosis does not mean you will find yourself having to pay more for life insurance. In fact, you can find insurance that will give you immediate coverage – without overpaying due to having diabetes! For many no medical examinations would be needed. The key is to know how to find the best policy. That is where we come in!

Our experience and knowledge can help put you in touch with the insurance companies that are most friendly to diabetics and offer non-diabetic rates. You are already dealing with a life altering health issue – you definitely don’t need high life insurance rates, too. Let us help you find the best policy to meet your needs and at the lowest rate.

At Diabetes Life Solutions, we have knowledge of diabetes and how it relates in the life insurance world. We know the ins and outs of these companies, including those who may or may not approve you for a reasonably priced policy. Why waste time and energy seeking policies from companies who will just decline you or ask you to pay a ridiculously high policy rate?

Our knowledge of your diagnosis allows us to understand how each company works and which would be the best for you! There’s no better resource online about all things life insurance and diabetes related. Nobody can do as good a job as we do for the diabetes community every day.

Contact us today to get started! We are always happy to speak to you. Simply give us a quick at 888 629 3064. The initial phone call takes about 5-10 minutes. Life insurance is a very important financial product for you and your family. Let us help you find the best diabetes life insurance policy possible.

Matt Schmidt

Matt Schmidt is a nationally licensed diabetes insurance expert. Over this time frame he's helped out over 10,000 clients secure life insurance coverage with Diabetes. He's frequently authors content to Forbes, Entrepreneur, The Simple Dollar, GoBanking Rates, MSN, Insurancenews.net, and Yahoo Finance and many more.

Matt Schmidt is also the Co-Founder of Diabetes Life Solutions and Licensed Insurance agent. He’s been working with the Diabetes community for over 18 years to find consumers the best life insurance policies. Since 2011, he has been a qualified non-member of MDRT, the most prestigious life insurance trade organization in the USA

Find out how much life insurance with Diabetes Life Solutions costs