Home » Life Insurance for SBA Loans [Quick Approvals & Simple Process]

Life Insurance for SBA Loans [Quick Approvals & Simple Process]

Matt Schmidt

Chris Stocker

To learn about Diabetes Life Solutions commitment to transparency and integrity, read our Editorial Disclosure

Last Updated on December 5, 2025

Life insurance with Diabetes is not always easy to obtain. In the event you have diabetes, and need a life insurance policy to complete your SBA Loan, don’t always expect this to be a quick process. For certain people, this application process may take up to FOUR weeks. Please do NOT wait until the very last second to obtain a life insurance policy. Allow yourself plenty of time.

Life insurance and a SBA loan work in a co-relation. SBA Loans will require life insurance as part of the collateral assignment process. In order for the lender to release the funds to you for your business, they’ll need to have the life insurance policy collaterally assigned to them. This means if you were to pass away, your lender received the death benefit of the policy. In the event the life insurance for SBA loans policy is greater than the outstanding loan amount, the difference is paid to a named beneficiary.

In the event you do not want to read this entire article, and would like information immediately, simply call us at 888-629-3064. An agent would be more than happy to visit with you about your specific situation. We understand that you may need life insurance for a SBA Loan in a timely manner.

Your assigned agent will walk you through the application process, and work with your lender to make sure they have everything they need.

If you are actively seeking small business loans for insurance companies, then that means you likely have a business plan and great idea that you want to get started on. With all the excitement of starting your business and getting your plan rolling, you may feel a bit discouraged and come to a screeching halt when you learn that in order to obtain your loan, you need life insurance. Many people do not realize that life insurance is generally needed for collateral, to be in compliance with the life insurance and a SBA Loan agreement.

You may find yourself asking these questions:

Why? How much is that going to cost? And where do I even start searching for life insurance with type 1 or type 2 diabetes? Or what is the process of underwriting and how long does it take to get an application approved?

Don’t fret. We’ve got some information for you that will help calm your fears and answer all your questions. Afterall, we are the experts when it comes to diabetes and life insurance! Diabetes Life Solutions ONLY works with people with diabetes, so this is something we specialize in. We’ve helped thousands people find an affordable life insurance policy, and helped hundreds of diabetics obtain life insurance for SBA loan.

An SBA Loan Defined

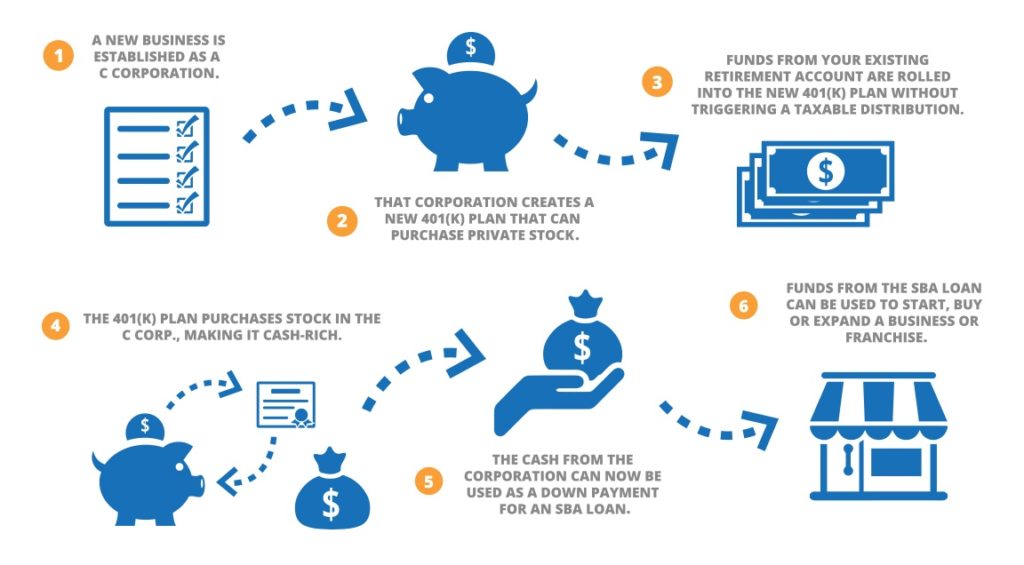

First, the SBA is a governmental office known as the Small Business Administration. They work with financial institutions throughout the country to provide entrepreneurs and other motivated individuals with funds to start up a business.

These funds come in the form of small business loans for insurance companies (hence, SBA loan). And, believe it or not, they are partially backed by the government. This makes it easier for financial institutions to offer loans to individuals with great ideas. After all, if your business plan falls through, they know that they will receive something from the government and it won’t be a total loss.

Most SBA loan life insurance range from $500 to $5.5 million. This money can be paid back on terms ranging from five to twenty-five years. However, ten to fifteen years is the most common repayment term.

Applying for an SBA Loan

Now that you know what an SBA loan is, you may be wondering what the application process looks like. Is it stringent? Is it simple? Here are the SBA loan life insurance requirements.

To be honest, obtaining one of these loans is not an easy task. There are some tough requirements, making you able to let your guard down only when you get a notification from your bank that the SBA loan funds have been deposited into your bank account.

One of the biggest surprises when applying for an SBA loan is the need for life insurance. You may not understand the significance, but without life insurance, you will not get approved for a loan. This is a means of security for the financial institution that – should you die – they will still get their money. Lenders are going to want to have you collaterally assign a life insurance policy to them, to cover the loan agreement. This may sound strange, but it is very common, and by the book.

Having Diabetes will also make it slightly more challenging finding a policy. Not every life insurance provider will view your health history the same. This is where we come in. We’ll take you through the application process and shop your health profile to several companies.

The Best Life Insurance for SBA Loans

There are different types of life insurance to consider. The two main choices for insurance are term life insurance and whole life insurance – each with their own pros and cons. But, when you are purchasing life insurance for your loan and not for your family, you may want to take different aspects into consideration.

So, which is the best life insurance for SBA loans and what are the SBA loan life insurance requirements?

Term life insurance will usually be your best option for life insurance to cover your loan should something happen to you during the life of the loan.

Term life insurance has great benefits:

- Some of the best rates in life insurance come with term policies.

- Rates do not increase during the term period of the life insurance policy.

- They can be sought at for different terms, such as 10, 15, 20 or even 30-year terms.

The reason term life insurance is the most affordable is that you are solely paying for the death benefit. Unlike whole life insurance, there is no cash value of funds over time. Whole life insurance is a more expensive type of policy, and is generally not recommended for a SBA loan. However, if your diabetes health profile doesn’t qualify for term life insurance, it may be your only option.

Instead, you are paying for a set amount of life insurance to be paid upon your death. If, for example, your life insurance is for $50,000.00. Then, during the term of your policy – should you die one week into the policy or just before it expires – your beneficiary will receive the death benefit amount, nothing more or nothing less.

The catch? If you don’t die during the term of the policy, then you are left with no benefit and you will have to seek a new policy. However, this may not be an issue whatsoever, as you are taking out the policy for a business loan. In most cases, you’ll want to buy a policy that pays the death benefit in the amount of the loan. You’ll probably not need additional life insurance riders, that drive up the cost of your premiums. However, you can add additional riders to your diabetes life insurance policy, if you think it’s a good idea. Just contact us at 888-629-3064 and an agent can discuss your options in great detail

Keep in mind that if you are only purchasing life insurance for your SBA loan, you may want to take out a policy that coincides with the length of your loan repayment. For example, a ten-year term life policy while you pay back your loan for the next ten years. This saves you from having to pay out any additional funds for life insurance after the loan is paid. Or, if you think you may need to use the same policy, for a future loan, it may make sense to lock in a policy for a longer term duration.

How Long is the Application Process?

Having Diabetes can make the life insurance process a little more tricky. Depending on your overall health, type of diabetes, and the AMOUNT of coverage you need, are going to really determine what types of policies you’ll qualify for. Because of this, you will not want to wait till the last second to begin applying for diabetic life insurance.

There are two types of underwriting that insurance companies will use. The first is a no medical exam policy, or a simplified issue life insurance policy. If you have type 2 diabetes, you would probably have several options to choose from, for a no medical exam policy. However, most companies limit the amount of coverage to $500,000 or more. If needing more than this, you would have the option to take out multiple policies, to meet your SBA loan obligation. People with type 1 diabetes will have fewer options for no medical exam coverage. Only a few companies would consider coverage on a non medical basis.

On average, non medical exam policies will take 24 hours, to 72 hours for an approval. You’d simply complete a basic application, answer health questions, and have your agent submit the application. When the life insurance carrier receives the application, they will simply process, request a Medical Information Bureau review, as well as review recent medications that have been prescribed.

Once the approval is made, and a policy is issued, you would be able to complete the collateral assignment paperwork with your lender. This is simply some additional paperwork, that is needed after the application process. Very easy stuff!!!

The second type of underwriting that insurance carriers use are what’s considered fully underwritten life insurance policies. These policies will require a blood and urine test, as well as a review of your medical and diabetes records. The lab results, and your health records will determine your approval, and your rates. Companies will make their offers based off how well your diabetes is managed, and off your overall health history.

Policies like these are NOT issued quickly. On average, it may take up to three or four weeks for an approval. If you’re in good overall health, and have good control of your A1C and diabetes, companies will make offers that are usually lower priced compared to no medical exam policies. The downside to this type of underwriting is that it may take 3 to 4 weeks to complete. So if you need immediate coverage, this option would be off the table. Please allow yourself the proper time frame to obtain life insurance coverage, if wanting the most competitive rates.

Choosing your Beneficiary – and the Collateral Assignment

The point behind the financial institution requiring you to have life insurance for your SBA loan is so that they are protected if you die before they receive their repayment money. You will apply for life insurance as normal, naming your spouse or other chosen individual(s) as your beneficiary.

However, you will then have to complete what is known as a Collateral Assignment form.

The Collateral Assignment form basically lets the insurance company know that, should you die, the holder of your SBA loan is first to be paid with your life insurance proceeds. In other words, your policy is being used as collateral for your loan. The lender, and life insurance company will sign off on this form, and will provide a letter detailing this, for your records.

Don’t worry, though. The financial institution will only take what is necessary to pay off the remainder of your loan. Then, the rest of your life insurance payout goes to your designated beneficiary.

Seek an Independent Agent for the Best Rates (especially for those with diabetes)

If you are feeling overwhelmed with the process or need some guidance, please reach out to us. We have helped thousands of people with Diabetes, secure an affordable life insurance policy to satisfy their SBA Loan. A quick five minute call to 888-629-3064 is all it takes. Or contact us here. Generally if looking for the best policy for your situation, you’d want to work with an independent life insurance agent from Diabetes Life Solutions. This means that you’d have several companies to choose from, to accomplish your financial goals.

Did you know that not all life insurance companies are created equal? Some offer policies, but they do not allow collateral assignments. This would not satisfy the requirements of the SBA, which means you would have just spent your time for nothing. Or maybe you have diabetes neuropathy or retinopathy. Not all companies would accept your health profile. Thankfully, our experienced independent agents know what to look for – and they know what insurance companies will meet the needs and requirements of the SBA.

You will want this knowledge to assist you as you go through the loan application process. The paperwork for an SBA loan is tedious. The same is true for life insurance. If you have a medical condition or have a health profile that is less than stellar, you may find obtaining an affordable life insurance policy next to impossible.

Diabetes Life Solutions knows how to look at your needs and your health conditions and find the best policy for you. We intimately know the insurance companies and their underwriters – which means they can head straight to the ones they know will be willing to give you a policy based on your situation. And, we promise to find the best possible policy, given your financial needs.

Our agents will get you through the process in a relatively painless manner. We’ll stay in touch with you, and your lender if needed. You will get just what you need to provide your SBA officer. No worries about holding up the process and delaying your funds.

We hope this article quenches your thirst for knowledge. We’d love to speak with you about obtaining the best life insurance policy – at the best rate. Whether you need life insurance for SBA loan or just to protect your family. We are here to be a diabetes life insurance resource to you! Contact us today at 888-629-3064!

Matt Schmidt

Matt Schmidt is a nationally licensed diabetes insurance expert. Over this time frame he's helped out over 10,000 clients secure life insurance coverage with Diabetes. He's frequently authors content to Forbes, Entrepreneur, The Simple Dollar, GoBanking Rates, MSN, Insurancenews.net, and Yahoo Finance and many more.

Matt Schmidt is also the Co-Founder of Diabetes Life Solutions and Licensed Insurance agent. He’s been working with the Diabetes community for over 18 years to find consumers the best life insurance policies. Since 2011, he has been a qualified non-member of MDRT, the most prestigious life insurance trade organization in the USAv

Find out how much life insurance with Diabetes Life Solutions costs