Chris Stocker is a financial services professional and licensed insurance agent. He's also Owner and author of The Life of a Diabetic as well as Type 1 Detour. He's been writing about Diabetes related topics for over 10 years, and has been featured in HealthLine, Diatribe, Diabetes Advocates and JDRF.. He's been writing about Diabetes related topics for over 10 years, and has been featured in HealthLine, Diatribe, Diabetes Advocates and JDRF.

Home » Life Insurance with Diabetic Retinopathy in 2026

Life Insurance with Diabetic Retinopathy in 2026

Matt Schmidt

Chris Stocker

To learn about Diabetes Life Solutions commitment to transparency and integrity, read our Editorial Disclosure

Last Updated on December 13, 2025

Finding affordable life insurance with diabetes is challenging enough and remove Finding affordable diabetic retinpathy travel insurance is hard enough

Good news! It still is possible to qualify for life insurance with a history of diabetic retinopathy. You may even be eligible for no medical exam life insurance policies. Diabetes Life Solutions is here to help you not just FIND coverage, but to help you find the best-priced life insurance with diabetic retinopathy policy, given your complete health profile. Every life insurance company will view your diabetes and retinopathy differently. One company may charge higher life insurance rates, while others may not charge higher premiums for your health profile.

To determine what your exact options are, we highly encourage you to contact us at 888-629-3064, and speak with an agent. Once we know more about your Diabetes, and retinopathy history, we can provide real and accurate quotes. We would love nothing more than to be able to help you find the best life insurance policy given your health profile, and financial situation.

By contacting us a licensed agent would be able to get a better understanding of your unique financial situation. Generally an initial phone call would take 5 minutes or less.

Without knowing your exact history of diabetes and retinopathy, it’s impossible for us to share what exact life insurance options available to you. Please simply complete a quote request, and work with us in order to determine specific life insurance options that are available.

Quick Article Guide

Here’s what we’ll cover in this post:

Retinopathy: A Diabetes Complication

If you have been diagnosed with diabetes, then you are aware that there are complications that can come along with it. Complications can occur gradually over time and if you do not properly monitor and manage your illness. Diabetic Retinopathy is one of those such complications.

What Is Retinopathy?

Retinopathy is a condition that occurs in individuals with both Type 1 diabetes and Type 2 diabetes. It continuously causes damage to the retina, which is the lining located at the back of the eye and is incredibly light-sensitive.

Although retinopathy itself is not life-threatening, it can, over time, completely destroy one’s sense of sight – resulting in blindness.

Credit: Genentech

What Causes It?

There are tiny blood vessels located within the retina. As with other areas within the body, diabetes may begin to cause these vessels in the eyes to leak fluids, including blood. This leaks into the macula which is the area of the retina that allows you to see clearly. In fact, it is responsible for our ability to see fine details and even colors.

The fluid begins to fill the macula, causing it to swell. The result is cloudy and blurry vision.

Your body may begin to try to improve the blood circulation within the retina. It does so by creating new tiny blood vessels on its surface. Unfortunately, they are not normal blood vessels and can leak blood into the back of the eye. This is how it blocks your vision.

Diabetic retinopathy may affect one eye, but typically both eyes feel its effects. The longer one has diabetes, the greater the chance of experiencing this condition. Having high blood sugar – hyperglycemia – for an extended period of time seems to be how the disease initiates within the body.

What are the Types of Retinopathy?

There are two types of diabetic retinopathy: Proliferative Diabetic Retinopathy (PDR) and Non-Proliferative Diabetic Retinopathy (NPDR).

+ Proliferative Diabetic Retinopathy (PDR)

This is an advanced stage of diabetic retinopathy. It occurs when poor circulation causes the retina to become deprived of oxygen. This, in turn, makes matters much worse. Fluids and blood begin to back up and leak at an even higher rate, leading to cloudy vision.

+ Non-Proliferative Diabetic Retinopathy (NPDR)

Non-Proliferative Diabetic Retinopathy refers to the condition in its earliest stages. In fact, some symptoms may be so mild that the individual may not even give it a second thought. However, while this is occurring unnoticed, the retina is falling victim. Fluids begin to leak and there will be some swelling in the retina due to the weakening of the blood vessels.

Who Is At Risk?

Anyone who has been diagnosed with either type 1 diabetes or type 2 diabetes are at risk for developing diabetic retinopathy. Typically, however, the symptoms of this condition do not start showing for many years. It is rare to see someone develop retinopathy early on in their diabetes.

While anyone with diabetes has a high chance of developing this disease, records seem to show that the Hispanic and African American population show a greater prevalence. People with other medical conditions, such as high blood pressure or high cholesterol are also at an increased risk.

Anybody who has a type of diabetes is technically at risk. And having a type of diabetes complication can make it more challenging to obtain life insurance coverage.

What Symptoms May Appear?

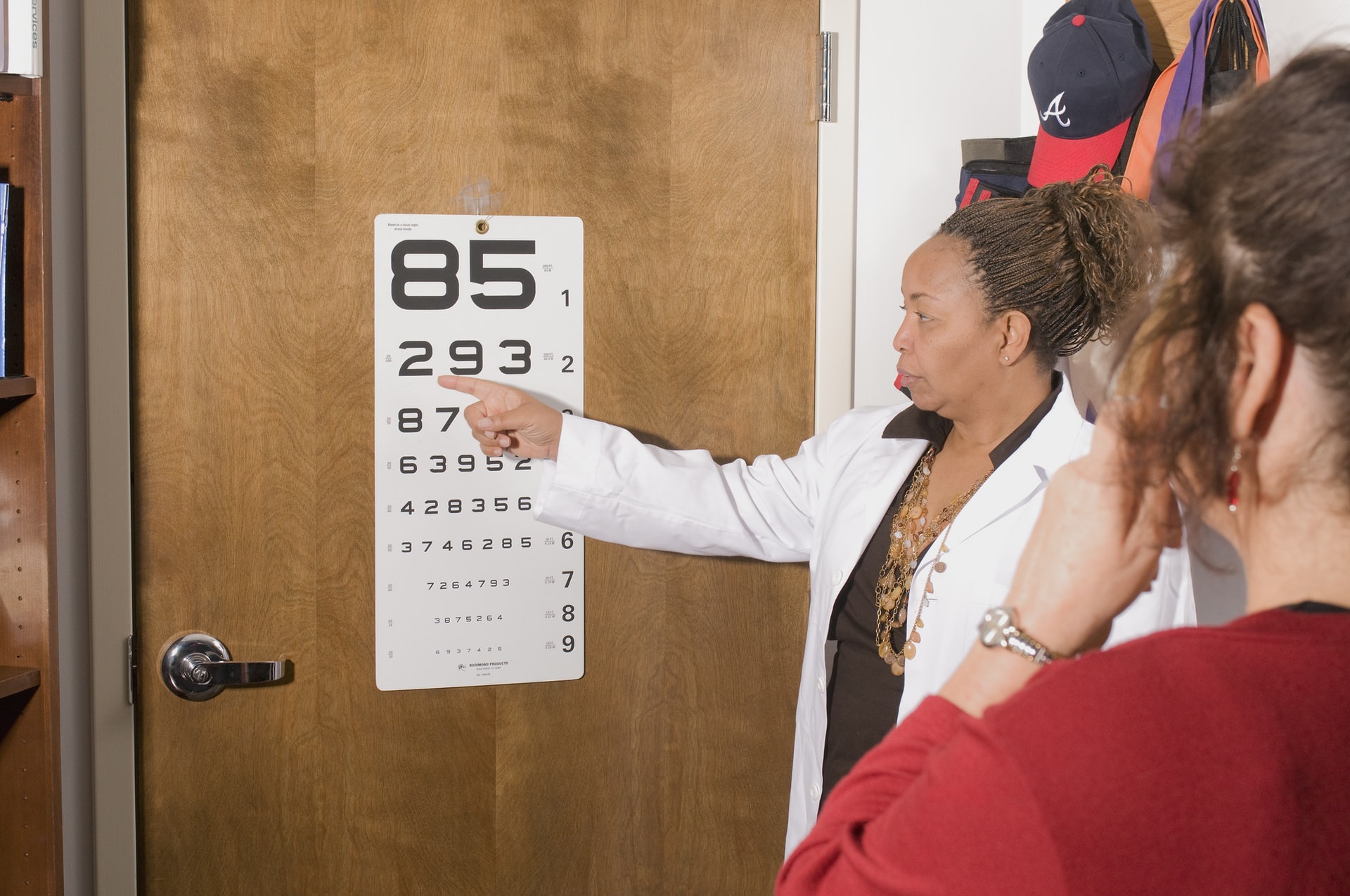

In the early stages of diabetic retinopathy, there may be no symptoms at all. Though, early detection is key. As a diabetic, you know how important health monitoring is – and this applies to your eyes, as well. The American Optometric Association strongly recommends that everyone with diabetes has a comprehensive dilated eye examination once a year. As the retinopathy progresses, the symptoms will begin to strengthen.

Some of the most predominant symptoms one may experience are:

- Blurred vision

- Loss of vision

- Seeing spots within your line of vision

- Trouble distinguishing between colors

- Dark strings, known as “floaters,” impairing your vision

- Dark areas within your vision

- Vision that fluctuates

- Complete loss of vision

If you are diabetic and begin to experience one or more of these symptoms, you will want to contact your eye doctor right away – as early detection can lead to better results.

Is it Treatable?

Your eye doctor will do a full eye exam to consider all factors regarding your symptoms. This will provide medical professionals with the most extensive look at your situation. From there, doctors will be able to see how to approach your eyes.

Treatment of diabetic retinopathy depends highly on what stage you are in – and your overall health. However, no matter what, the ultimate goal to slow the progression of the disease or halt it altogether.

For those who present in the non-proliferative diabetic retinopathy stage, there is not much to do. Having the disease caught in this early stage means that doctors can monitor it and attack when necessary. Following the advice to keep your diabetes under control is probably the best piece of advice you will get from doctors. Monitor your blood sugar, eat appropriately, get exercise, and following any other instructions from your doctor. Doing these simple things in the NPDR stage could help control the progression of the disease.

Once the condition reaches the proliferative diabetic retinopathy stage, more immediate action needs to be taken. If the blood vessels begin leaking, doctors can begin using a laser treatment known as photocoagulation to stop the fluid and blood from leaking. The laser creates burns in the retina area with abnormal blood vessels. This is an attempt to try to seal the leaks.

In the most advanced stages, when there is a widespread growth of blood vessels in the retina, doctors will use the laser to create a pattern of burns across the retina. As a result, the abnormal vessels will get smaller and smaller until they finally disappear.

How Do Life Insurance Companies View Diabetic Retinopathy?

Having a history of diabetic retinopathy will require a little more information to be gathered, before you could know your life insurance with diabetic retinopathy options, and possible rates. Best case scenario is that companies don’t ‘view’ you as a higher risk, and you will not pay ‘higher’ life insurance premiums. Worst case scenario you may pay more for life insurance, or possibly declined for coverage altogether.

To be honest, most life insurance companies are going to view a person with diabetes complications very cautiously. Several will flat out not even consider you for coverage and will automatically decline you. While we feel it’s unfair, it’s simply how their underwriting guidelines work. Other companies are more understanding of people with diabetes retinopathy, and will consider it on a case by case basis.

We want to reiterate that it’s 1000% impossible to determine your options until you speak with us, or request a quote from us. If you’re a person who wants to review REAL and ACCURATE life insurance information, please take a few minutes to reach out to us. Let us help you save money on your life insurance premiums as we are specialists with life insurance for diabetics.

You’ll want to share with us the following in order to determine what rates and options you may have:

- Age first diagnosed with retinopathy

- How severe is your history of retinopathy?

- What type of treatment? ( medications, or surgery)

- Do you see an ophthalmologist on a regular basis?

In addition to this information about your retinopathy, diabetic retinopathy travel insurance companies will also need to know specifics about your diabetes and health history.

Sample questions that life insurance companies will collect are as follows:

- Age of Diabetic Onset

- Current medications, if any, being prescribed to help control your diabetes.

- Any use of Diabetes technology such as a CGM?

- Most recent A1C reading.

- Any other diabetic complications outside of Retinopathy?

- How often do you test your blood sugar ?

- Any other medications currently taking outside of Diabetes medications?

- Any other major health issues such as cancer, heart attacks, strokes, HIV, sleep apnea, depression, anxiety etc.?

- Any use of tobacco products within the last year

- What is your current height and weight?

Life insurance companies will determine your rates based on the following criteria:

- Type of Policy

- Term Length if choosing term life insurance

- Amount of life insurance

- Overall health

- Use of Tobacco products

- Control of your Diabetes

- Age of Diabetes onset

- Severity of Diabetes-related complications, if any

- Age at the time of applying for life insurance

Life insurance companies will consider you for consideration, once they have an idea of your overall health profile. Also, when working with Diabetes Life Solutions, you don’t have to fill out multiple applications, or take multiple blood and urine tests.

You simply complete one application, consent to a blood/urine exam, allow us to order your most recent diabetes records, and from there we can have several different life insurance companies look at your profile. This process is called the underwriting of life insurance. The various companies will then make their offers, and we’ll present those to you. When you know the final pricing to your diabetes life insurance policies, you can choose what company, how much life insurance, and what type of policy to move forward with. People with diabetic retinopathy would have both term life insurance and whole life insurance options available to them.

If your retinopathy was treated through a surgery, and there’s been no recurring issues, several life insurance companies will not rate you higher for life insurance. Now if there have been continual issues with your diabetic retinopathy, companies may add additional ‘table ratings’ to your policy. This means the premiums would be 25% higher, or more, compared to a diabetic without retinopathy.

Long story short, the better your control of diabetes and retinopathy, the lower your diabetes life insurance rates. If your retinopathy isn’t being controlled, and you have other significant health issues, you may only qualify for guaranteed issue life insurance policies.

The only way to determine what exact life insurance with diabetic retinopathy options you’d have available is by contacting us, or completing an online quote request. Once an agent has a better idea of your overall health, they will be able to make suitable recommendations for you.

Final Thoughts

Problems with your vision are nothing to take lightly. As a diabetic, you will want to stay up on your health, monitor your diabetes, and take the steps you can to remain as healthy as possible. Diabetic retinopathy doesn’t have to wreak havoc on your eyes if you don’t want it to. Regular monitoring can be the difference between having a vision and not.

Don’t let your diabetes complications hinder you from finding life insurance. Using a skilled agent can be your easiest route to the best rates for the best coverage. Simply contact us, and put us to work on your behalf!! A 5 minute phone call to 888-629-3064 is all it takes to begin discovering what diabetic life insurance options you may have.

Diabetes Life Solutions has helped thousands of people with diabetic retinopathy find affordable life insurance. We’ll make the life insurance process simple and easy for you.

Matt Schmidt

Matt Schmidt is a nationally licensed diabetes insurance expert. Over this time frame he's helped out over 10,000 clients secure life insurance coverage with Diabetes. He's frequently authors content to Forbes, Entrepreneur, The Simple Dollar, GoBanking Rates, MSN, Insurancenews.net, and Yahoo Finance and many more.

Matt Schmidt is also the Co-Founder of Diabetes Life Solutions and Licensed Insurance agent. He’s been working with the Diabetes community for over 18 years to find consumers the best life insurance policies. Since 2011, he has been a qualified non-member of MDRT, the most prestigious life insurance trade organization in the USA

Find out how much life insurance with Diabetes Life Solutions costs