An entrepreneur at heart, Chris has been building and writing in consumer life insurance and health for over 11 years. He's contributed to 1,000+ medical, health, financial and wellness articles and product reviews written in the last 11 years.In addition to Pharmacists.org, Chris and his Acme Health LLC Brand Team own and operate Diabetic.org, PregnancyResource.org, Multivitamin.org, and the USA Rx Pharmacy Discount Card powered by Pharmacists.org.Chris has a CFA (Chartered Financial Analyst) designation and is a proud member of the American Medical Writer’s Association (AMWA), the International Society for Medical Publication Professionals (ISMPP), the National Association of Science Writers (NASW), the Council of Science Editors, the Author’s Guild, and the Editorial Freelance Association (EFA).

Home » How to Save Money on Life Insurance by Laddering Policies

How to Save Money on Life Insurance by Laddering Policies

Matt Schmidt

Chris Riley

To learn about Diabetes Life Solutions commitment to transparency and integrity, read our Editorial Disclosure

Last Updated on February 24, 2026

If someone asked you what your life is going to look like next year, could you truthfully and factually tell them? The answer is no because, honestly, you don’t know. Life can throw us so many curve balls, twists, and turns that it is impossible to know what the future holds. Next year, you could be facing life in a new city, an unexpected pregnancy, a career change, and so forth.

When it comes to purchasing life insurance, you are often advised to take a look at your financial situation, dependents, etc. and make a determination on what you think you may need. If you can’t confidently and honestly answer what you will be doing next year, how in the world can you plan your life situation and insurance needs in 30 years? Or let’s say in 40 years.

Simply stated: you can’t. Nobody can.

This is where the idea of laddering life insurance policies comes in. A little trick to pay for what you need when you need it most, without having to waste money in the future unnecessarily. Many people will benefit from having multiple life insurance policies, for various lengths and amounts of coverage, to protect their loved ones in the event of an untimely death. Here’s how it works.

Laddering policies together may NOT always work to lower premiums. But in several instances, we’ve been able to help consumers save considerably by utilizing this strategy. Perhaps this simple trick will be best for your unique situation.

Understanding the Laddering Strategy

According to PolicyGenius, Life insurance policies are priced according to three major variables:

- How long the policy lasts (a 20-year term policy costs more than a 10-year term policy)

- How much coverage you want (a $500,000 policy costs more than a $250,000 policy)

- Your personal health (a person with a complicated health history will have a more expensive policy than a person in good health)

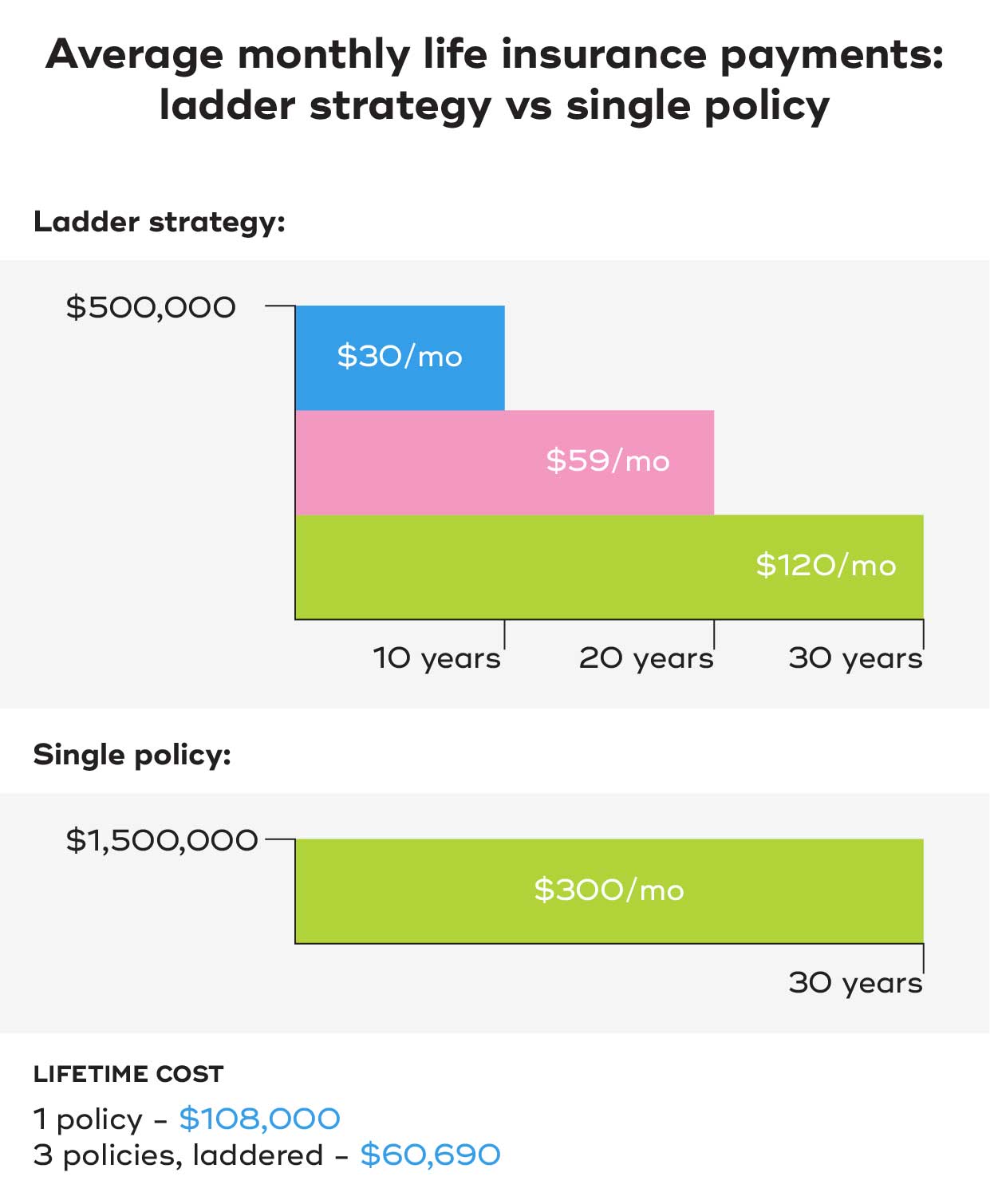

The ladder strategy takes advantage of the first two variables to keep premium costs low by ensuring that you’re only ever paying for the amount of life insurance you need, and it takes advantage of the third variable by locking in low rates for each life insurance policy when you’re young and healthy.

As an example, as you get older, there’s a greater chance that you may develop a form of a diabetes-related complication. Any type of diabetes complication, such as Neuropathy or Retinopathy will make life insurance more expensive. If you apply while having a type of complication, your life insurance rates will probably be more expensive. Or maybe you’ve had some other health issue such as a heart attack. Life insurance will be extremely difficult and expensive to purchase if having a history of diabetes complications or severe health issues.

Let’s say that you are in your 30’s with a family. Your kids are currently in school, but in the next few years they will be attending college and, hopefully, getting married. Once that happens, you and your spouse plan to downsize the house and do some traveling. After all, you’d be free to do so.

Based on your current situation, should something happen to you, there are a lot of responsibilities, both current and in the near future, that need to be taken care of. By choosing a life insurance policy with a decently high payout you can ensure that your kids can move through life as planned without any interruption or hardship.

As they age, however, your need for a rather high life insurance policy is going to decrease.

For example, if you believe you need a $1,000,000.00 policy now, will you still need that in 20 years? Likely not. Yet, taking out a 30-year term, $1,000,000.00 policy will result in you paying the premium for 30 years, whether you need that much or not.

With term life insurance, your rates are partially determined by the length of a policy you choose. A 30 year term life insurance policy will cost more than let’s say a 20 year term life insurance policy. As you also know, rates are determined by your overall health, control of type 1 or type 2 diabetes, in addition to the amount of life insurance you are purchasing.

For many people, purchasing just one policy may not be ideal. Using a laddering technique, or combining multiple policies together, who all have different term lengths and amount of coverage, may make financial sense. You can even ‘ladder’ a term life insurance policy together with permanent life insurance such as Guaranteed Universal Life and Whole Life Insurance policies.

What a Life Insurance Ladder Looks Like

A life insurance ladder is simply a technique where an insured takes out multiple life insurance policies, where each policy addresses a specific financial goal. For example, if you believe that your life will require you to have more life insurance today than you will need in the future, we’ve already determined that taking out a 30-year policy with one specific amount of life insurance may not be the way to go.

This is where laddering term life insurance comes in.

Let’s say you estimate your ideal life insurance amount now – and for the next 10 years – to be about $1,500,000. Then, in 20 years when your kids are grown and out of college, it’d be more ideal to have a life insurance policy in the amount of $1,000,000.00. In 30 years, you and your spouse plan to have a hefty retirement account set up and have your house paid for. Because you are better off financially, without as many responsibilities, you estimate your ideal life insurance to be around $500,000.00.

Life insurance ladder strategy makes this happen. Instead of taking out one 30-year life insurance, why not consider taking out three?

Let’s break this down. Here is the breakdown of the three policies you would take out:

Your premium payments will drop off after 10-years and after 20-years. Meaning the first two policies would expire, if still living. Which isn’t a HUGE deal, because possibly your need for life insurance has decreased. You are only left paying premiums for 30-years on $500,000.00 – rather than the $1,500,000.00 that you didn’t need.

How to Set Up a Life Insurance Ladder

In order to determine how to take advantage of laddering term life insurance for yourself, there are a few key things that you will need to consider. These include your estimated expenses, your estimated worth, and finding the best life insurance company who’ll make the most competitive offers due to your history of diabetes. Don’t think you have to do this on your own. A friendly agent at Diabetes Life Solutions is standing by, to work alongside you.

1. You are going to need to estimate your future expenses.

Note that this estimation is going to have to include both your current – and your future – expenses. Before you panic, thinking this is a daunting task, relax. This is just an estimate.

Take time to look at your life. Do you have kids? If not, do you plan on having kids? Are you going to want to provide enough life insurance to cover College expenses? Do you own a home or plan on purchasing one? What does your debt look like now? Are you taking steps to cut down on your debt (be realistic here) or do you see yourself having more debt in the future?

These are the types of questions you need to openly and honestly review in order to estimate the amount of coverage you are going to require through each season of your life.

2. Next, it is time to estimate your net worth.

Truly, you cannot possibly know what the future holds for you. However, when it comes to purchasing life insurance, you’ve got to have an idea of how you think or hope your life turns out.

Will you be making more money in the future? Do you have investments that you expect to grow? Will you still be owning a large home in 20-years? Or, do you intend to downsize your tangible assets as you age, such as when the kids leave home?

Valuing what your net worth will look like in the future will give you a good idea of how much life insurance you are going to need.

3. Work with an agent who specializes in Diabetes Life Insurance.

When you are purchasing life insurance, you always want to shop around and find the best policy, given your financial objectives. Unfortunately, many life insurance agents are not properly trained, to work with the Diabetes community.

Many agents will provide FAKE quotes, meaning that the rates they show are not realistic. They do this to trick you into applying for coverage. Then, after you go thru the underwriting process, your rates come back much, much higher. You don’t have to worry about this, when you work with Diabetes Life Solutions. We’ll only provide you with REAL and ACCURATE information from the very beginning.

When you are choosing life insurance ladder strategy, you are buying multiple policies. Therefore, you want to know that you are getting the best deal possible. Contacting an independent agent at Diabetes Life Solutions is a great way to see this through successfully. Many of our clients save 20% to 30% on their life insurance premiums, when working with us. This leads to substantial savings over the life time of life insurance policies.

What is the Application Process?

After you speak with an agent, and share your ideas and personal situation, you’ll need to apply for coverage. Depending on your Diabetes and health history, you may qualify for no medical exam policies. An insurance company would use the information on your application, as well as doing a Medical Information Bureau review, to determine eligibility.

After you speak with an agent, and share your ideas and personal situation, you’ll need to apply for coverage. Depending on your Diabetes and health history, you may qualify for no medical exam policies. An insurance company would use the information on your application, as well as doing a Medical Information Bureau review, to determine eligibility.

If you qualify, and wish for a no medical exam policy, you would simply complete an application. Upon approval, your agent would provide the life insurance company specific issuing instructions, for the ‘multiple’ policies.

In some cases, it may be smart to apply for a fully underwritten life insurance policy. These policies require a blood and urine exam, as well as a review of your most recent Diabetes medical records. After you complete an application, you’ll complete the paramedical exam. Once lab results, and medical records are received, they’ll be forwarded onto an Underwriter. All this vital information will determine your ‘final’ offers. Your agent will then share the offers, and you determine how to have your policies issued.

Will Life Insurance Laddering Benefit You?

Life insurance laddering is not for everyone. To reap the benefits of this idea, you need to be able to somewhat effectively estimate your life and the amount of life insurance ladder strategy that you will need. For some, such as those individuals who are following the typical life format – marriage, purchase home, kids, growing career – estimation comes a bit easier.

For example, you know you will need to plan for more expenses when your kids are younger and as they attend college. And, you can then downsize as they are older – and your expenses and debt decrease.

But, what about those individuals who choose to have children later in life, are renting rather than purchasing homes, and decide to never get married? If you live life on the edge with spontaneity rather than predictability, perhaps insurance laddering may not be the best choice. We do understand that having multiple policies at the same time can feel overwhelming. But don’t let it be. Our agents not only help clients establish life insurance coverage, but they stay in touch with you through the years. We are here to stay in touch and make sure your policies match your financial objectives over time.

When a person applies for life insurance through us, we’ll obtain various offers, and present multiple possible solutions to you. Once you know the final pricing of the insurance, you can determine if laddering life insurance policies together makes financial sense or not for you. Not everybody needs to ladder policies together. But for many, it may make perfect sense to explore these options.

Talk over all your options and your current situation with an agent at Diabetes Life Solutions today! He or she will help you decide the best way to approach your life insurance needs – making sure you get the best insurance policy at the best rate.

Talk over all your options and your current situation with an agent at Diabetes Life Solutions today! He or she will help you decide the best way to approach your life insurance needs – making sure you get the best insurance policy at the best rate.

We love working with the Diabetes community. This is all we do, every day of the year. Put our expertise, and honest to work for you today. Don’t make these important decisions by yourself. Share your personal situation with us, and we’ll do our best to provide open and honest recommendations. Applying for life insurance with diabetes can be a little tricky. Let us help!

Contact us today at 888-629-3064, and let us find you the best life insurance solutions available!

Matt Schmidt

Matt Schmidt is a nationally licensed diabetes insurance expert. Over this time frame he's helped out over 10,000 clients secure life insurance coverage with Diabetes. He's frequently authors content to Forbes, Entrepreneur, The Simple Dollar, GoBanking Rates, MSN, Insurancenews.net, and Yahoo Finance and many more.

Matt Schmidt is also the Co-Founder of Diabetes Life Solutions and Licensed Insurance agent. He’s been working with the Diabetes community for over 18 years to find consumers the best life insurance policies. Since 2011, he has been a qualified non-member of MDRT, the most prestigious life insurance trade organization in the USA

Find out how much life insurance with Diabetes Life Solutions costs