Last Updated on February 24, 2026

The working parent isn’t the only one that should purchase a life insurance policy; both parents are equally as valuable to a family, but often the value of a stay-at-home parent is overlooked. This is presumably due to the fact that the stay-at-home parent is not generating income, but it is important to understand the expenses that would be placed upon the family in the event of the absence of the stay-at-home moms or dad. Looking for insurance is the best thing you can do for them. You might be wondering about how much life insurance for a stay at home parent cost?

Stay-at-home parents are truly a financial value to a family – especially families that have several small children or even a child with diabetes. Currently, there are approximately 11 million moms, and 2.4 million dads, who are stay at home parents. And if you are one of these individuals, you know how hard your job is!!!

Stay-at-home parents are truly a financial value to a family – especially families that have several small children or even a child with diabetes. Currently, there are approximately 11 million moms, and 2.4 million dads, who are stay at home parents. And if you are one of these individuals, you know how hard your job is!!!

Making the decision to purchase life insurance for the stay-at-home mom/dad is one of the best investments that you can make when considering your family’s financial security and preparedness. If you have Type 1 or Type 2 Diabetes, you should have several options available to you, in the form of life insurance. We know you’ve heard the rumors that people with Diabetes don’t qualify for affordable life insurance, but that is no longer the case. Diabetes Life Solutions was founded to help families obtain this valuable life insurance coverage! We are the leading experts in this field, and we’d love the opportunity to help!

What Type of Life Insurance Policy Should I Have???

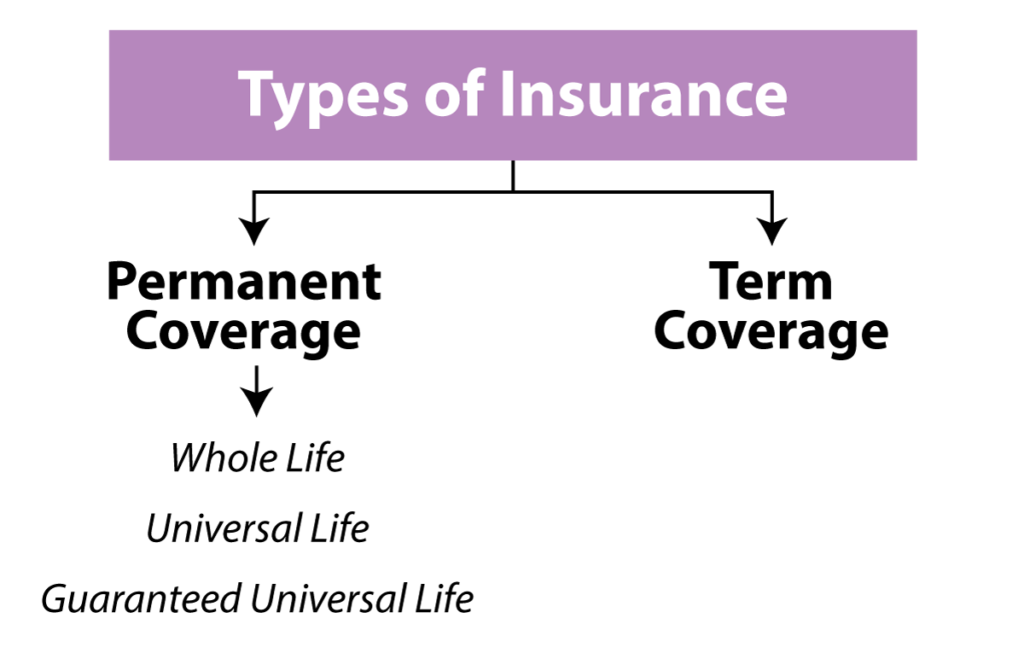

With life insurance, there are two main types. Term, and Permanent coverage. Which type of policy that is ideal for yourself, or family, will need to be determined by looking at your overall financial picture, and your exact need for life insurance coverage. Great news for people with Diabetes! Diabetics can qualify for both types of life insurance policies.

A term life insurance policy will provide you life insurance protection, for a specific period of time. Examples of time frames are 10 , 15, 20, 25, 30, or 35 year term periods. During the initial term period of your policy, rates will not increase, and coverage cannot be canceled unless you choose to do so. If you were to pass away during this time frame, your beneficiary would receive the full payment or death benefit of the policy.

Some Pro’s to term life insurance is that it’s lower priced, compared to permanent forms, is that it’s initially less expensive. Many people with Diabetes may qualify for policies that do not require medical exams. Some Con’s to term life insurance is that a policy may not provide life insurance coverage for a duration, that a person may truly need. If waiting to reapply for coverage, at the end of a term period, the new policy would have much higher rates. This is due to the new policy being based off your current age, at time of re-applying.

With permanent life insurance, the policy would cover a person’s entire life. Some types of permanent insurance accumulate cash value. The cash value grows tax deferred over life time of policy. You can also access the cash value thru a loan provision. Or if not interested in a policy feature such as this, you can look at policies who simply provide a guaranteed death benefit, along with guaranteed premiums.

Although permanent life insurance for stay at home mom is more expensive then term life insurance, it again covers a person’s life. If health were to ever change, you do not have to worry about having policy canceled, or having your premiums increased. These are some of the advantages for a permanent policy, compared to a term insurance policy.

If you are not sure which type of a policy suits you, our Diabetes Life Insurance Advisors are always happy to speak with you. You can share with them your situation, and we’ll make some unbiased recommendations that are in your best interest.

How Much Coverage should a Stay at Home Parent Have???

Everyone’s situation is different, at nobodies situation is quite the same. According to Dave Ramsey,

he recommends anywhere from $250,000 to $500,000 in life insurance coverage. You may think “breadwinner” when you read the word “provider.” But stay-at-home parents who don’t earn incomes are also providers, and their contributions should be considered when families think about.

Ideally, both parents should have life insurance. Most families would prefer to maintain its standard of living, in event of one spouse dying. In most situations, the spouses may not need to have the same amount of life insurance in force, life insurance for stay at home mom would be more than dad and vice-versa. Usually, the breadwinner would have a need for a higher amount of coverage. As life changes for your family, you could always even add coverage for the stay at home parent in the future, if the need is thee

It’s not that easy to put a price tag on parenting. There are so many expenses to consider, when raising a child, and taking care of your family, it’s hard to pinpoint an exact amount. So now you might be thinking how much life insurance for a stay at home parent? Below, we’ll detail some of these expenses that you may want to consider, before determining an amount of life insurance for stay at home parents.

When Should I take out a Policy?

With life insurance, usually the younger you are, the lower your rates. Not to mention that if you have Diabetes, the older you become, the greater chance you have to develop diabetes complications. This may lead to higher rates, or a possible decline all together. You never want to put off an important issue, such as life insurance. Life insurance with diabetes costs will vary from person to person. Your are at time of application, and your overall health, will determine the rates.

Over time, should you not need coverage, you can cancel policies. Or if you don’t have enough coverage, you can take additional policies, and coverage amounts. If you’re like most people with Diabetes, in search of life insurance, you’ll want to go with a policy that fits your finances. As your family’s finances change so can your life insurance coverage.

Daycare Expenses

Daycare Expenses

Stay at home parents are major providers within a family. While they aren’t salaried and aren’t bringing in tangible income, their contributions are endless. For a family with several small children, many families cannot afford the cost of daycare expenses, which is usually the primary reason that originally prompts the parent to assume their role as a stay-at-home parent.

In a country where the average cost of daycare for just two children is $8,000-$28,000, it’s easy to understand the substantial financial benefit of a parent who cares for their children at home instead of maintaining a presence in the workforce. It is important to understand the amount of financial burden that a family would experience in the event that the stay-at-home parent passed, such as childcare expenses would immediately break any budget that has once been sustainable.

Lost Wages by the Working Parent

An often overlooked expense is the loss of wages that the working parent would endure while taking the necessary time off to mourn and get the family’s affairs in order after the loss of a stay-at-home parent. While most jobs allow a certain amount of vacation time that the working parent could request, that may not be enough time to develop a new routine and adjust to life without a second caregiver present in the home.

In the event that the working parent would need to forfeit wages for a portion of time in order to prioritize the family’s adjustment process, it is important to be mindful of the financial nest egg that the family would need to be able to take the time that they need.

Pay Off Debt

Pay Off Debt

Most people have some form of debt. Whether it be car payments, house payments, credit cards, or personal or student loans. Your family may find it beneficial to include the total of outstanding debt within their figured approximation of how much life insurance they would like to apply for. In a time of loss where the family will already be consumed with trying to adjust emotionally and mechanically, the ability to remedy outstanding debt can alleviate some of the hardships that the family will have to endure.

College Saving

When something as difficult as a loss occurs, it can be somewhat comforting to know that certain things are taken care of. Including the cost of college for your children in the total of the policy amount you apply for can provide your children a great financial start to life. Not having to worry about tuition can alleviate the financial cost that the sole living parent would feel responsible for, and would give the children a financially sound start in life so that they would never feel the need to choose between an education and substantial debt.

This isn’t something that all families feel the need to add into their coverage amount, but it is certainly worth considering.

In-Home Help: Cooking, Errands, Housework

Parenting isn’t easy. It’s a lot of work for two parents who work well together to stay on top of all of the cooking, cleaning, and home maintenance and childcare. Losing the input of a parent can be overwhelming for the living parent – not to mention exhausting. It’s beneficial to consider the possible help that the living parent may need to hire. A nanny, assistant, or maid service can be extremely costly. Accounting for the expense in your coverage amount can make life after a loss much easier for the remaining family.

We hope that this article will help spark the conversation to obtain life insurance for the stay at home parent in your household. Having diabetes, should never deter you from obtaining an affordable life insurance policy. There are a plethora of life insurance options available, to people in the diabetes community.

Our agency was founded to help those with Diabetes, obtain coverage. To receive a quote you can CONTACT us, or give us a quick call at 888-629-3064. Our agents are always willing to help anyone with diabetes. We’ll answer any questions you may have, and provide you with whatever life insurance information you are seeking.

Every day we are helping the diabetes community with this issue. Life Insurance for stay-at-home moms can seem overwhelming at times. That’s where we come in. We’ll make everything as simple as possible, for you and your family. Being a stay at home parent is an important ‘job’, and one that should be protected with life insurance for stay at home parents coverage.